Q: If a pension is for when you retire, and you’ve got years and years before you get there, there’s not much point in saving for one when you’re younger, right?

A: Although a pension is designed for later life, typically after you stop working, the earlier you save into a pension, the better. There’s four reasons why:

1.You benefit from compound growth

2.You get free money

3.Your pension has longer to grow

4.You spend more time in the market to smooth out any ups and downs

Here’s why:

1. You take advantage of compound growth

The longer you save into a pension, the bigger the growth on your savings can be. That’s because, as well as evening out the ups and downs of the stock market, there’s more time for it to grow.

The growth you get from your pension benefits from compounding. A bit like the interest in a cash savings account.

It’s when you earn interest on both the initial money you’ve saved, as well as the interest your money has earned.

Let’s break it down

1.Amira pops £1,200 into a personal pension each year.

2.Suppose her investments grow evenly at a rate of 5% per year after all charges have been applied. . By the end of the year her £1,200 will have grown to £1,260.

3.In year two she pays in another £1,200 so she now has £2,460 invested. If that grows by another 5% (after charges), she’ll finish year two with £2,583.

That’s how compounding works.

2. You get free money

Yes really – it’s given to you through ‘tax relief’. If you’re a UK taxpayer, then the government will automatically top up payments you make to your pension. If you’re a basic rate (20%) taxpayer, it means that every £100 put into your pension only costs you £80. The government pay in the other £20.

So, let’s look at how that would affect Amira.

1.She puts £1,200 into her pension each year.

2.The government adds basic rate tax relief to her contributions, a topping it up by an extra £300 - giving her a total of £1,500 in contributions.

3.That 5% growth (after charges) in year one will now equal £75, so by the end of the year she’ll have £1,575.

4.And in year two Amira contributes another £1,200 to her pot, and the government adds another £300 to that. Her total pot now stands at £3,075 invested. And if that grows by 5% again, she’ll make £154 of growth – giving her a grand total of £3,229 by the end of year two.

*If you’re a higher or additional rate taxpayer then you could also receive another 20% or 25% in tax relief too. Find out more about pension tax relief here.

3. Your pension is left to grooooow

Because a pension is designed for your later life, it’s typically left to grow for longer. This means you could accumulate more compound growth compared to someone saving for shorter periods of time.

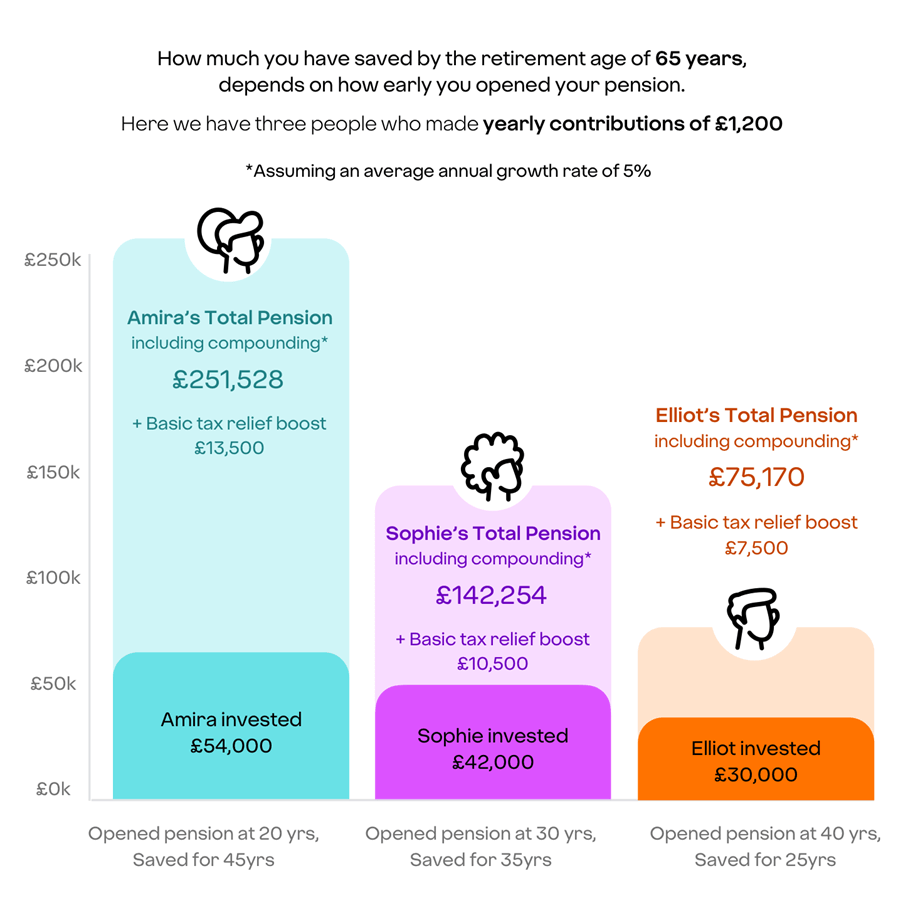

The example below gives you an idea of what it would look like when opening and saving into a pension at different ages. The younger you are, the more compound growth your pension will benefit from.

*In this example we assumed that all three examples would stay at basic rate tax for the time they saved into their pension, but this might not be the case in a real-world setting.

If you want to see what your own pension savings could look like, use our Navigator pension Calculator

4. The ups and downs of the stock market is water off a duck’s back

…And you’re the duck.

It’s no secret that there is an element of risk when it comes to investing in the stock market. And it can be really scary to think about losing money.

But when you invest for longer periods of time:

- It gives you more of an opportunity to recover from any losses.

- It weathers out the financial storms in the market. You might hear this referred to as recovering from market volatility, which is just a fancy way of saying, where there’s a down, there’s often an up.

- When the stock market is down, it means you’re buying assets at a lower price and when it’s booming, it means you’re buying assets at a higher price. When you make regular contributions, you take advantage of something called pound-cost-averaging, which means you average out the higher and lower costs to even out your returns.

Where to next?

- Feeling good about your learning and want more? Check out the rest of our helpful guides

- Want to see what your retirement could look like? Have a nosey around our calculator

Charges for a pension are typically calculated as a % of its value. They cover the costs of things like running the pension account and fund fees. They can vary from one provider to another, but you can find information about our charges here.

Your pension is designed for later life. When you save into a pension, the value of your investment could fall and you could get back less money than you put in. You usually can’t access your pension until age 55 (rising to 57 from 6 April 2028). Tax rules can change and depend on your personal circumstances.

This article can give you helpful tips, but it isn’t financial, or tax advice. If you’re not sure if something is right for you, you should speak to an Independent Financial Adviser.