Balance transfer credit cards

Find the right balance

Get 0% interest on balance transfers for up to 34 months. Fees and terms apply.

Representative example: 27.9% APR Representative (variable). Based on assumed credit limit of £1,200 and a purchase rate of 27.9% p.a. (variable).

Check your eligibilityPromotional offer varies based on your circumstances and starts from account opening date. Applies to transfers made in the first 60 days.

What is a balance transfer credit card?

You can move part or all of the balance from other credit or store cards to a balance transfer credit card. You'll get:

- 0% interest on transfers for up to 34 months

- Applies to transfers made in the first 60 days. Fees apply.

- 0% interest on purchases for 3 months

- Save on interest and make your money go further. Offer starts from account opening.

- Easy-peasy payments

- Manage your debt in one place, with one monthly payment. Simple!

Credit is available, subject to status, only to UK residents aged 18 or over.

Balance transfer basics

- When your offer ends

- You’ll be charged the current standard rate of interest from the start of that statement period. The same applies if you miss a minimum monthly payment.

- Transfer up to 95% of your credit limit

- You can transfer as many cards as you need. A fee applies for each transfer.

- Already bank with us?

- You cannot transfer a balance from another Virgin Money Credit Card. You should not use your card to repay other borrowing from Virgin Money.

Questions about balance transfer credit cards

Are you paying interest on existing credit or store cards? A balance transfer credit card could help.

Transferring your balances to a single 0% card means you’ll pay no interest for the promotional period. This could save you money and help you become debt free faster.

There's usually a transfer fee. You should work out if you will still be saving money after paying the fee. You could still be better off.

Consider how long your promotional rate lasts and what you can afford to pay monthly. Paying only the minimum may take longer and cost more to repay. Setting up a Direct Debit can help you stay on track.

If you decide that a balance transfer credit card is right for you, there's a few things to be aware of:

- We charge a one-off transfer fee.

- You can transfer as many cards as you need, as long as you don't transfer more than 95% of your credit limit.

- The 0% interest rate only applies to balance transfers made within the first 60 days. You'll lose your 0% rate if you miss a minimum monthly payment. You'll then pay the standard rate of interest from the start of that statement period.

- You cannot transfer a balance from another Virgin Money Credit Card. You should not use your card to repay other borrowing from Virgin Money.

- When your promotional rate ends you'll be charged at the standard rate of interest.

Completing a balance transfer won't hurt your credit score. But applying for a balance transfer credit card could temporarily lower it. This is because:

- We'll do a hard credit check when you apply for a credit card. It helps us to understand your credit history. A hard credit check can impact your credit score.

- Applying for too many cards or loans, especially in a short space of time, could lower your credit score.

- Make sure to check your eligibility first before you apply. An eligibility search shows up as a soft credit check on your credit report. This does not impact your credit score.

However, you don’t have one universal credit score. Each lender will calculate scores in different ways. They can use your application, credit report and their own data if you already bank with them. You can check your own credit report by visiting TransUnion, Equifax or Experian.

A balance transfer credit card could also boost your score, if you:

- Make regular payments to pay off your debts. Over time, this could improve your credit score.

- Reduce your credit utilisation. This is the percentage of your available credit that you're using. Keeping your credit utilisation low shows you’re managing your debt well. This is good for your credit score. Generally, you should aim to use no more than 25% of your total credit limit.

- Having long held, well-managed credit accounts can also improve your credit score. This shows you’ve been a reliable borrower in the past.

Our balance transfer credit cards come with a money transfer option. They let you move up to 95% of your credit card limit into your current account. We’re pleased to be one of the few credit card providers who offer them.

We sometimes offer 0% interest promotional rates and fees on money transfers. If you’re offered one, you’ll need to make a transfer within 60 days of opening your account to get the promotional offer. After this the standard interest rate and fee will apply.

You shouldn’t use your money transfer to repay other borrowing from us.

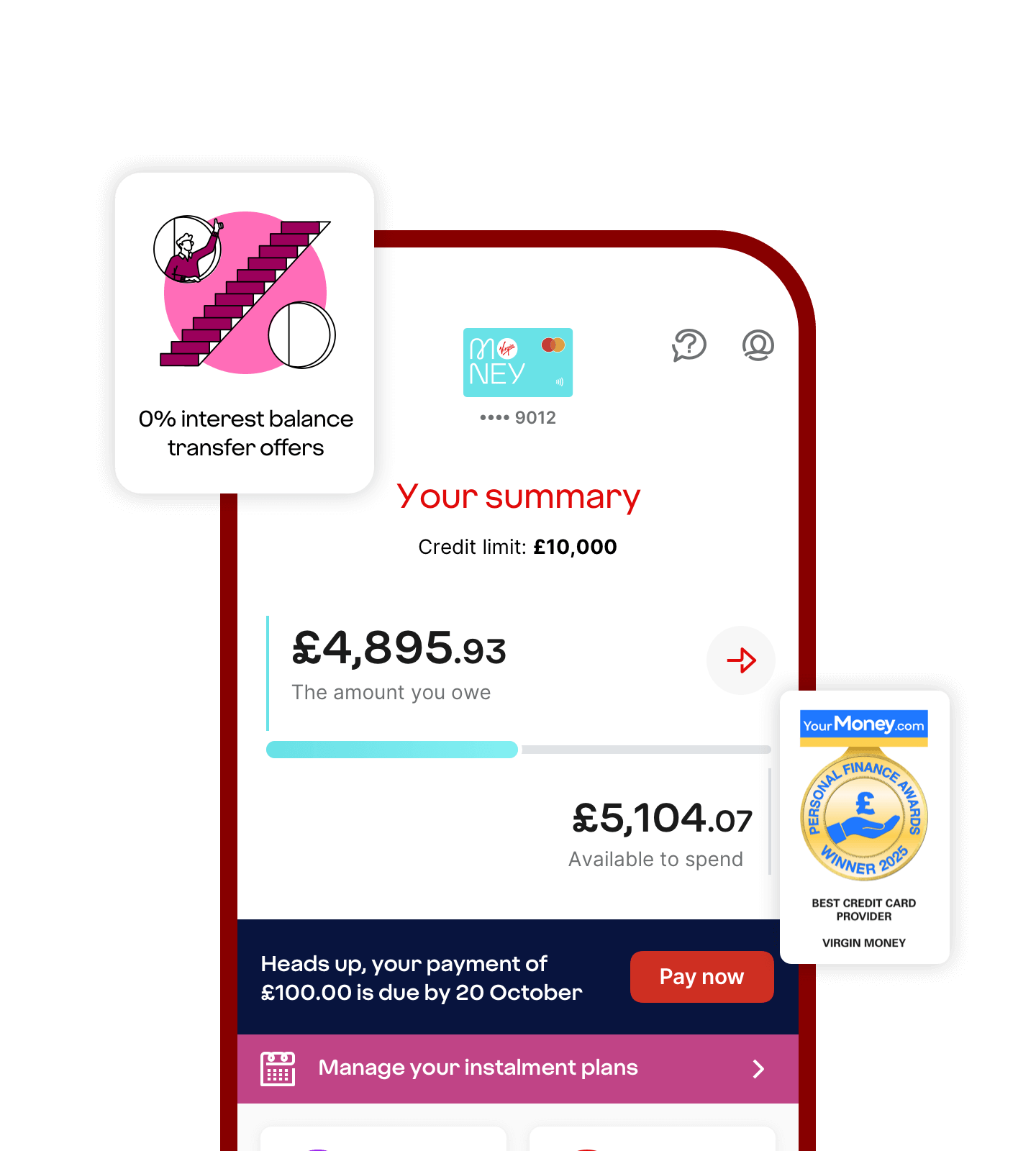

It’s quick and easy to make a balance transfer.

- To manage your card, you'll need the Virgin Money Credit Card app.

- Go to the payments section.

- Tap ‘Make a balance transfer’ and follow the steps.

The money will be in your account in 3 days if no extra checks are needed.

Check your eligibility

Before you apply, use our card checker

- know your chances of being accepted

- you'll see your minimum credit limit on pre-approved cards

- it won't affect your credit score

To manage your card, you'll need the Virgin Money Credit Card app.

Check your eligibilityThe legal bits

Time to give your scrolly finger a workout

Calls are charged at your service provider’s prevailing rate and may be monitored and recorded.

The Virgin Money Credit Card is issued by Clydesdale Bank PLC (trading as Virgin Money). Registered in Scotland (Company No. SC001111). Registered Office: 177 Bothwell Street, Glasgow, G2 7ER. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

You're pre-approved

Close ModalThis means you'll get this card if you apply before midnight on {{campaignenddate}}

- When you apply, we'll do a credit check, that's the norm for all lending applications

- Your application would only be declined if you're out of employment, not a UK resident or for fraud reasons

Virgin Money's business will become part of Nationwide on 2 April 2026, subject to court approval.

Understand what this means for you Link opens in a new windowGreat news about your card

You're pre-approved! If you apply for this card you'll be accepted, as long as you:

- start your application within the next 20 minutes

- complete your application today

- don't change any of the details you previously shared

- pass our standard identity checks

Guaranteed credit limit

Close ModalWe can offer you at least this credit limit based on the info you've shared.

You'll get this credit limit as long as you:

- don't change any of the details you previously shared

- pass our standard identity checks

- start your application within the next 20 minutes

- complete your application today

Need more?

You can tell us in your application if you need more for a balance transfer. We'll consider this when we look at your credit limit again. This means your new credit limit may be higher.

Want less?

Once you've got your credit card, there's an online form you can use to reduce your credit limit.

Close ModalOk, got itVirgin Money's business will become part of Nationwide on 2 April 2026, subject to court approval.

Understand what this means for you Link opens in a new windowGood news about your card

You're highly likely to be approved, as long as you:

- start your application within the next 20 minutes.

- complete your application today

- don't change any of the details you previously shared

- pass our standard identity checks