For the super savers

Saving up for a holiday or just a rainy day? We’ll boost your balance with our exclusive savings rates.

6.50%

AER1 Gross2 P.A.

A bank account for your 11 to 15s

If you have an eligible current account with us, you can apply for an M Power Account for your child. It’s a proper bank account that comes with a debit card and a nifty app. And, it’s all for free.

View M Power AccountPut your home in our hands

Exclusive mortgage rates through our Current Account Reward mortgages. First-time buyers, remortgagers and house-movers are all welcome.

View mortgage offer

Virgin Atlantic Reward+ Credit Card offer

Bag a whopping 30,000 Virgin Points. That's enough for flights to New York.

Representative 69.7% APR (variable).

Subject to status. You'll need to be 18+ and a UK resident. Terms and annual fee apply. Taxes, fees and carrier-imposed surcharges payable separately.

Virgin Atlantic Credit CardSweet dreams are made of this

Virgin Money customers can unlock a saving of up to 30% on stays at Virgin Hotels. Just click on the link below to head to the website, enter promo code VMFriends and show your Virgin Money card to grab this deal. Terms apply Link opens in a new window.

Book my stay Link opens in a new window

Terms

UK only. Flexible cancellation up to 24 hours prior to arrival. A credit card is required to secure the booking. Room only. Single room bookings only. Subject to availability. Cannot be used in conjunction with any other offer. Guests will need to show their Virgin Money debit card on arrival. Offer open to Personal and Business customers. This is valid on stays up to 31 December 2025. Terms apply.

And it doesn’t end there

We reward Virgin Money customers with cashback and access to Virgin Red. From time to time we also have other offers available. Check the 'Discover' section of the Virgin Money Mobile Banking app for more info.

Cashback on travel insurance

Planning a trip? You can get a sizzling 5% cashback on Virgin Money travel insurance.

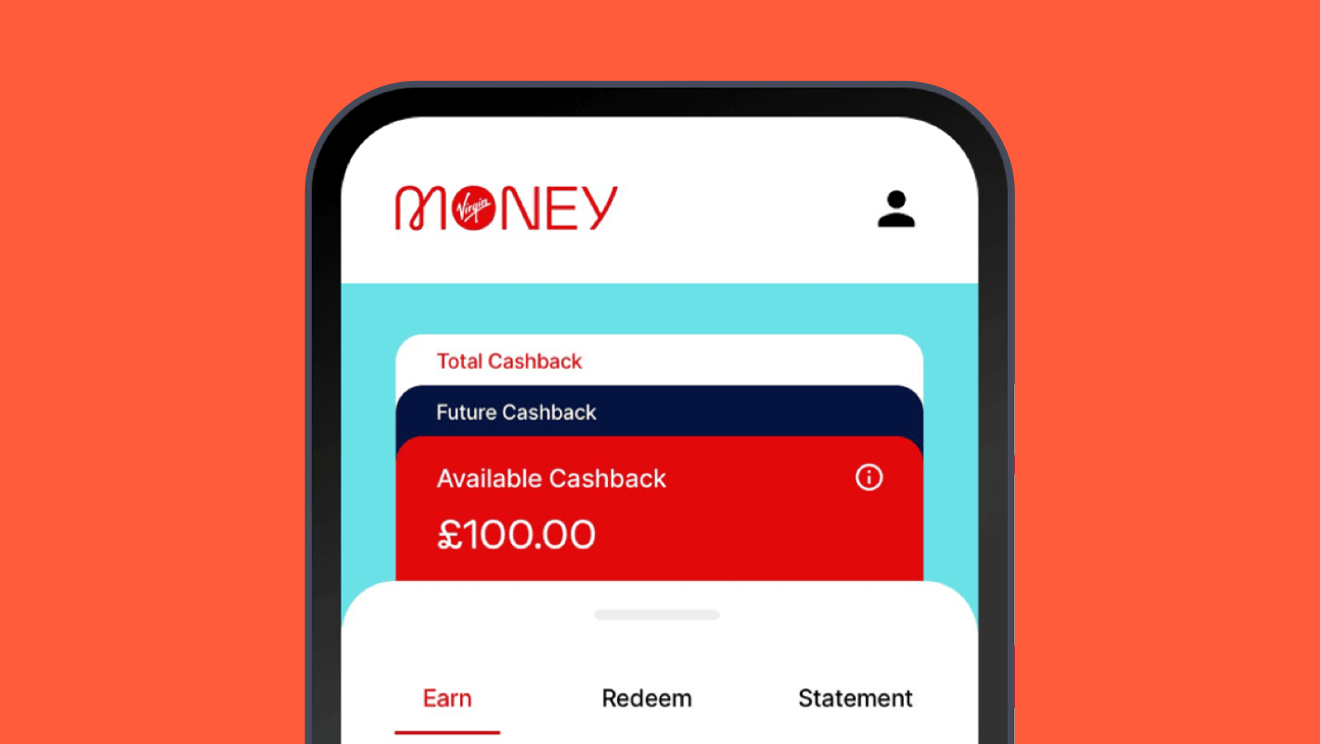

Other cashback offers

Earn money while you spend with Virgin Money Cashback. Check the app for latest offers, and then watch your balance build.

Virgin Red

Turn the things you do already into Virgin Points. There are over 150 ways to rack up points and you can spend them on things like flights, gigs or nights away.

Apply for one of our accounts and unlock our exclusives

Everyday bank account

M Plus Account

No monthly fee for maintaining the account

Everything you'd expect from a current account, plus:

- Exclusive access to other accounts, offers, cashback and more.

- A linked saver account with 2.00% AER (1.99% gross p.a. variable) on balances up to £25,000. 1.50% AER (1.49% gross) on balances above £25,000. Interest paid quarterly.

This rate applies from 3 November 2025. Until then, you'll earn 2.25% AER (2.23% gross per annum variable) on balances up to £25,000 and 1.75% AER (1.74% gross), on any balances above £25,000. - 1.00% AER on your current account balance up to £1,000. Interest paid monthly.

Packaged bank account

Club M Account

£12.50 monthly fee for maintaining the account

All the features of the M Plus Account, as well as:

- Worldwide family multi-trip travel insurance.

- Worldwide family mobile and gadget insurance.

- UK and Europe breakdown cover.

Basic bank account

M Account

No monthly fee for maintaining the account

Great if you have little, poor, or no credit history

- It's the same as our M Plus Account, but you won't get interest paid on your current account balance. We also won't be able to offer you an overdraft or a cheque book.

- Open this account with non-standard ID.

- You can only apply by phone or in Branch.

Interest explained

- AER stands for Annual Equivalent Rate, and illustrates what the interest rate would be if interest was paid and compounded once each year.

- APR stands for Annual Percentage Rate. If you have a credit card, the APR is the cost of using your card to borrow money over a 12 month period.

- Credit interest is calculated daily on the cleared credit balance in your account.

- Gross is the interest payable without taking account of any tax payable.

- p.a. stands for per annum, which means every year.

- The tax-free rate is the contractual rate of interest payable where interest is exempt from income tax.

1 AER stands for Annual Equivalent Rate and shows what the interest rate would be if interest was paid and added to the capital balance each year.

2 Gross P.A. is the rate of interest paid without the deduction of tax.