A new home for investments and pensions

Our investments and pensions business is being sold to Octopus Money, subject to approval by the Financial Conduct Authority (FCA).

Read moreBetter together

Wouldn't it be good to see all your cash working hard for you in one place?

Transferring your investment accounts to Virgin Money can make them simpler to manage – giving you a clearer view of how they’re performing.

Moving to us is easy – just choose your investing approach, tell us which accounts you’d like to transfer and we’ll do the rest.

Award-winning

Your Money Stocks and Shares ISA award-winner eight years running.

Straightforward

No jargon, no waffle, just three no-nonsense investment choices.

See our approachesGood value

Our experts invest your money worldwide to reduce risk and help it grow, at a fair price.

Learn more about chargesResponsible

We make investment decisions that consider people and the planet.

See how we invest responsiblyRewarding

Treat yourself with rewards from the Virgin family and beyond.

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

Let’s get going

It’s easy to get started in just a few minutes.

- Choose how you’d like to grow your money

Select your investing approach (from Cautious to Adventurous) then our experts take care of the rest.

- Open an account and tell us about the ISAs you want to transfer

The more you can tell us about the ISAs you'd like to transfer to us, the quicker it should be to move your money.

Check before you transfer - That's it, nothing more to do

We'll be in touch if we need more info, and we'll let you know as soon as your transfer is done and your account is set up.

Our 3 approaches

Discover which approach matches the ups and downs you're comfortable with when growing your money in the longer term

Cautious growth

Balanced growth

Adventurous growth

A lower-risk way to invest long term. Fewer ups and downs, lower potential returns, fewer sleepless nights.

The potential to grow your money with a few more ups and downs along the way. The Goldilocks choice.

Investment confident? This one's got more ups and downs for higher potential returns. Go big or go home.

Investment Mix

Close Modal- Higher potential returns and risk

- Lower potential returns and risk

The Investment Mix shows you how much of your money typically goes into higher risk investments with higher potential returns, and how much goes into lower risk investments with lower potential returns.

For more info, check out our guide.

Investing money and the risks.

Learn about investing

Get to grips with investing with helpful tips, guides and videos from our investment experts.

Check it outThe ins and outs

It's easy to transfer your existing cash ISA and stocks and shares ISAs to us. Here's a few things to keep in mind when transferring:

- We don't set a minimum for transfers, even small amounts are welcome.

- Sorry, we can't accept transfers of Help to Buy, Innovation Finance, Lifetime or Junior.

- We can accept ISAs that you've paid into in this tax year, previous tax years, or both.

- Transfers are made in cash, so your current investments will be sold first. You’ll be out of the market until your transfer completes. This means you won’t lose out if the markets fall but, likewise, you won’t benefit if markets rise.

- We don't charge you to transfer to us, but please check whether your current provider will charge you to leave before you start your transfer.

- We’ll process your transfer as quickly as possible but, just so you know, transferring between providers can take several weeks.

See how much your money could grow

Use our quick and easy calculator to see how bright your financial future could be.

Stocks and Shares ISA calculatorReady to apply?

If you know enough about our Stocks and Shares ISA and just want to get going, click below.

Choose your approachGood to know

Our terms

Everything you need to know. Includes the Key Features of our Investment Account and how we use your personal information.

Protecting your money

Sleep easy with protection on deposits up to £85,000. Provided through the Financial Services Compensation Scheme (FSCS).

About the FSCS

Fund Value Assessment

A report showing whether our funds are providing good value and our plans if there are things we think we can improve.

Read the latest report

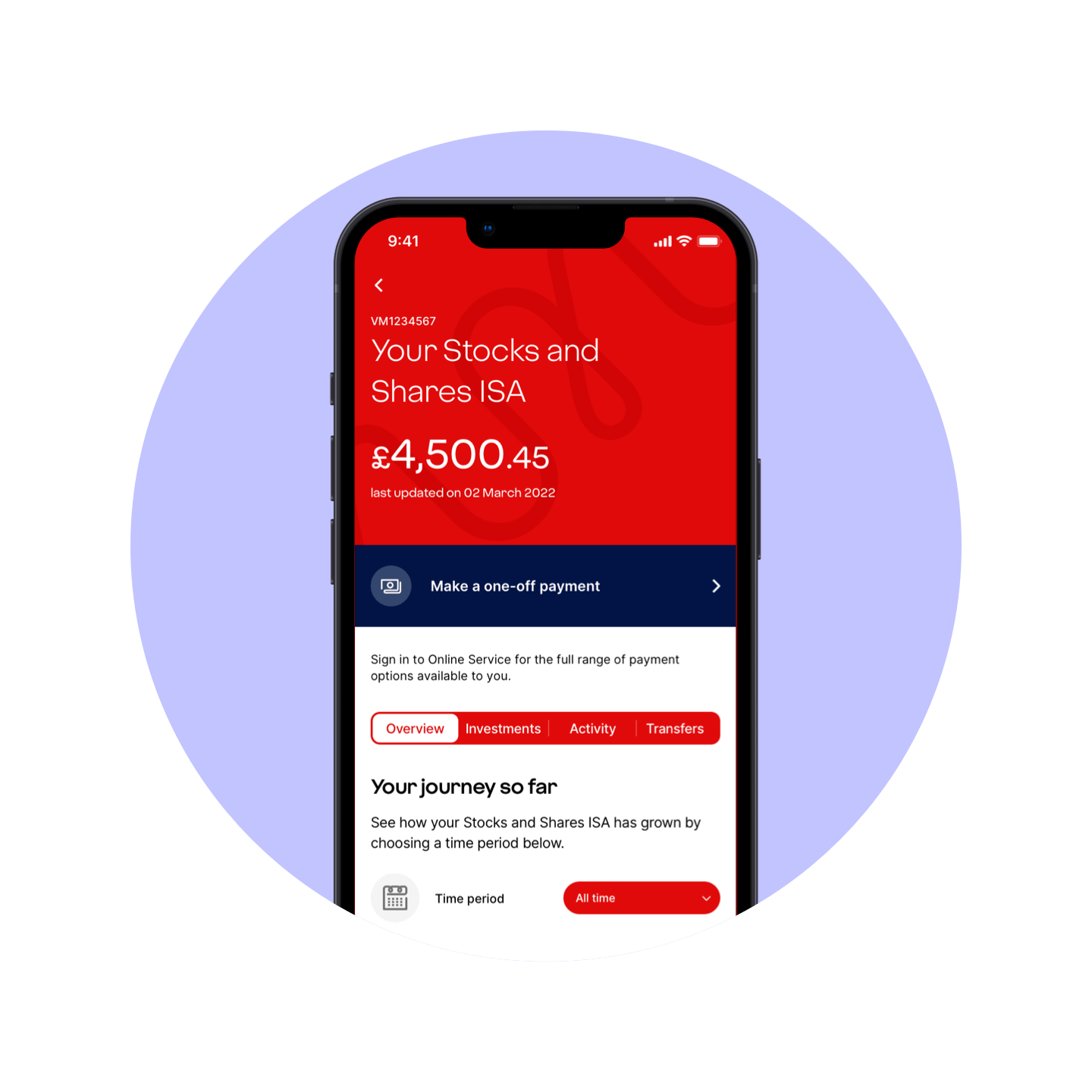

Online Service and app

Stay in control with our Online Service and app, making it easy to keep track of your investments wherever you are.

Explore Online ServiceGot a question?

We've got the answer.

You can transfer ISAs from previous tax years to Virgin Money without affecting this year's ISA allowance. If you want to transfer an ISA that you've contributed to in the current tax year, it counts towards your annual allowance.

That depends on the type of investments you have and who your provider is. Sometimes it can take a few weeks, but we'll make it as quick and easy as we can. Here's how it works.

You give us details of the account(s) you want to transfer – including your current provider, your plan or account reference and the amount you want to transfer.

We'll contact your existing provider and usually get everything sorted online. Some providers won’t accept a digital signature, so we might get in touch again to ask you to sign and return a transfer form by post.

You'll be able to track the progress of your transfer in Online Service and we'll let you know when everything's complete.

You can transfer as many ISAs as you like from previous tax years. Just give us the details when you apply, or transfer them one at a time once you've opened your account.

Remember, you can't transfer a Help to Buy ISA, Innovative Finance ISA or Junior ISA.