Taking a look back at '22

Here we are in 2023, but one thing hasn't changed - every penny still counts.

So, we're looking back at where our customers went and spent with their current account in 2022. If you're looking to stay close to your money this year and max the brilliant benefits of your account then read on to find out more.

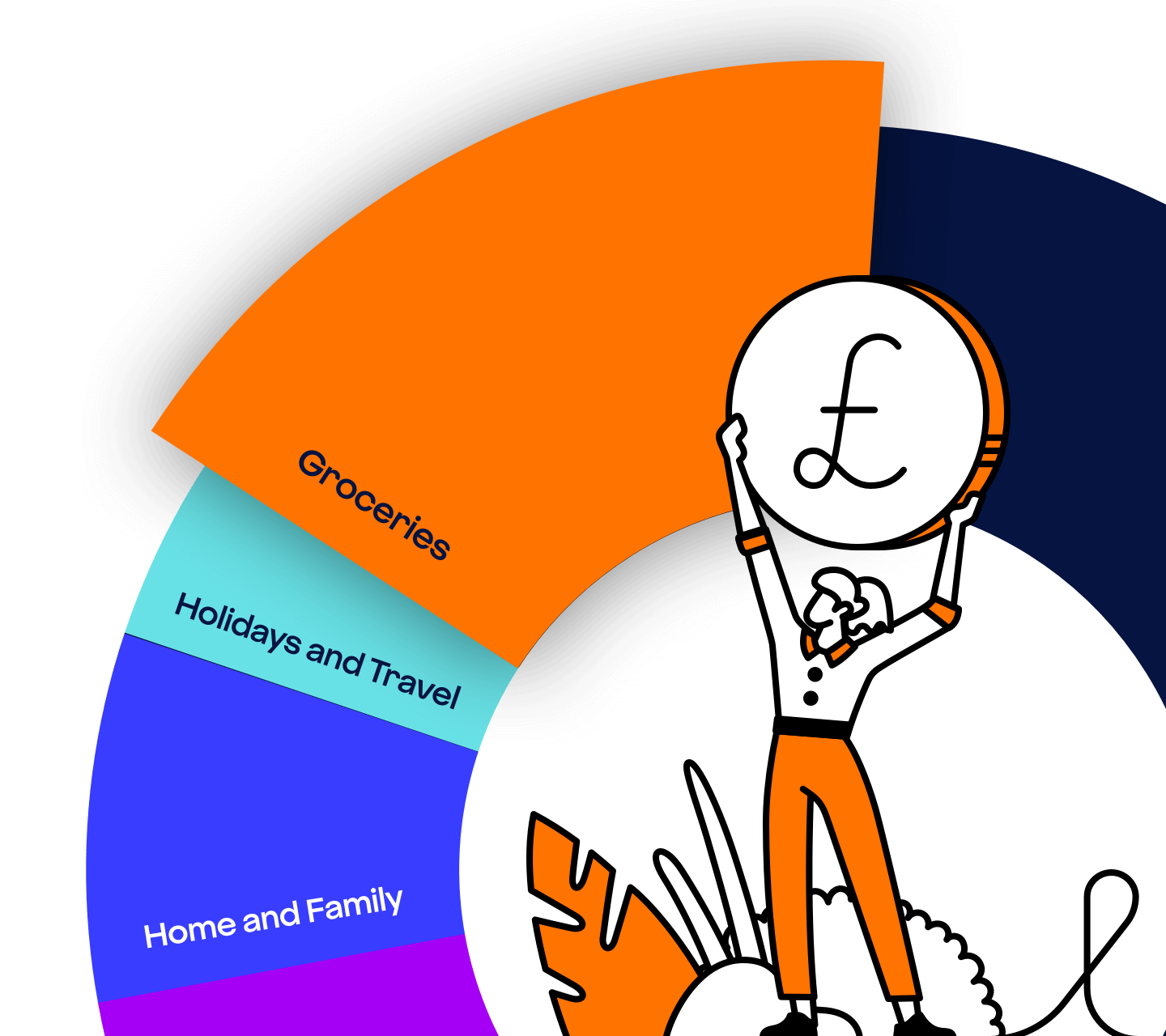

Your spend trends

We've crunched the numbers to find the top spending categories for our current account customers in 20221. How did your spending compare?

- General spending (shown as 'Everything else') took the biggest piece of the pie

- Grocery spend closely followed in second place - those weekly shops add up!

- 2022 saw a return to spending on Holidays and Travel

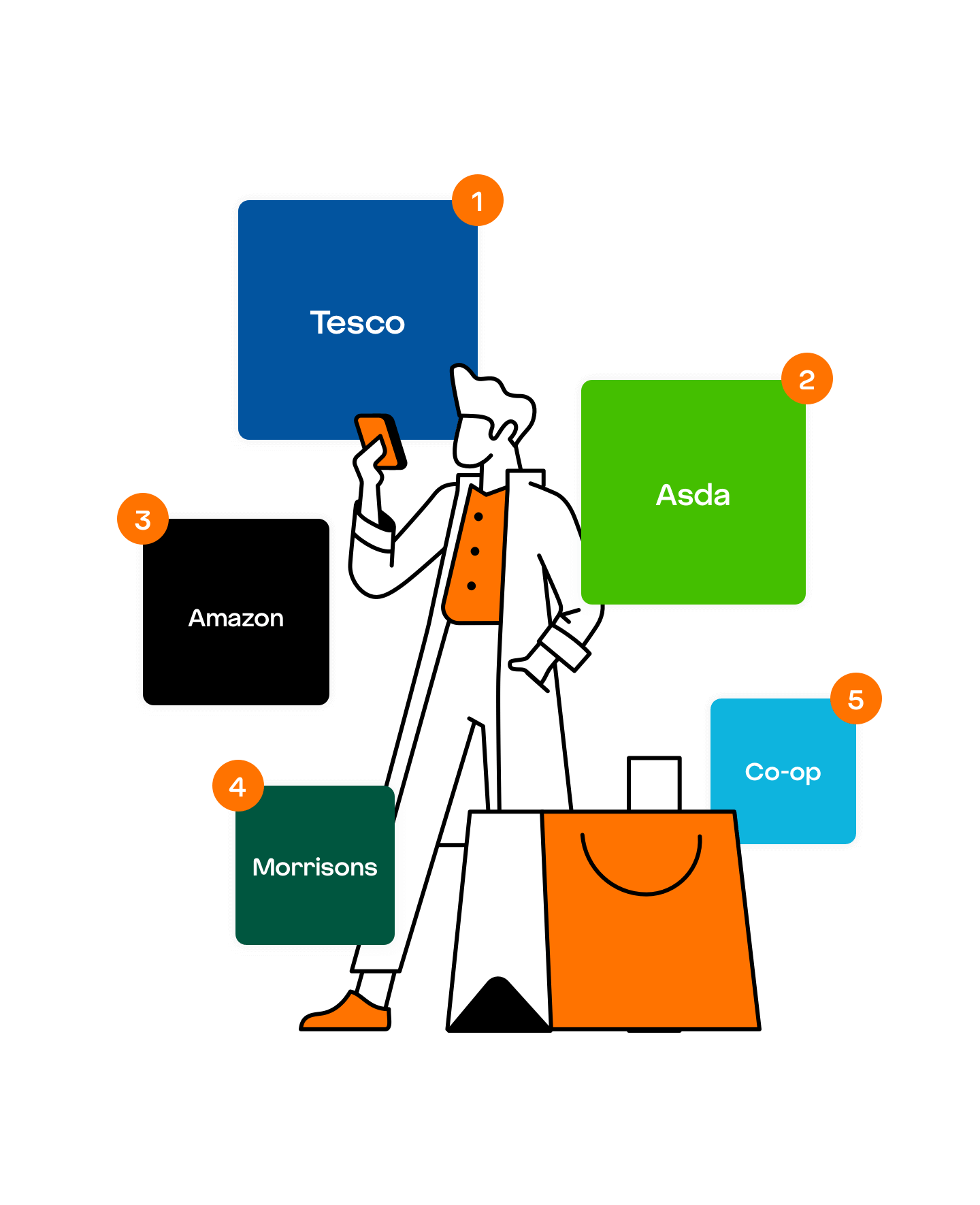

Top 2022 brands

Check out some of the most popular brands our customers spent with in 2022. Did your favourite brands make the list?

With groceries ranking high as a popular spending category, it's no surprise that supermarkets dominated the top five2.

- Tesco

- Asda

- Amazon

- Morrisons

- Co-op

How we'll support you in 2023 (and beyond!)

From our nifty banking app, digital know-how sessions, cool cashback rewards and a red-hot savings rate, discover all the ways we've got your back.

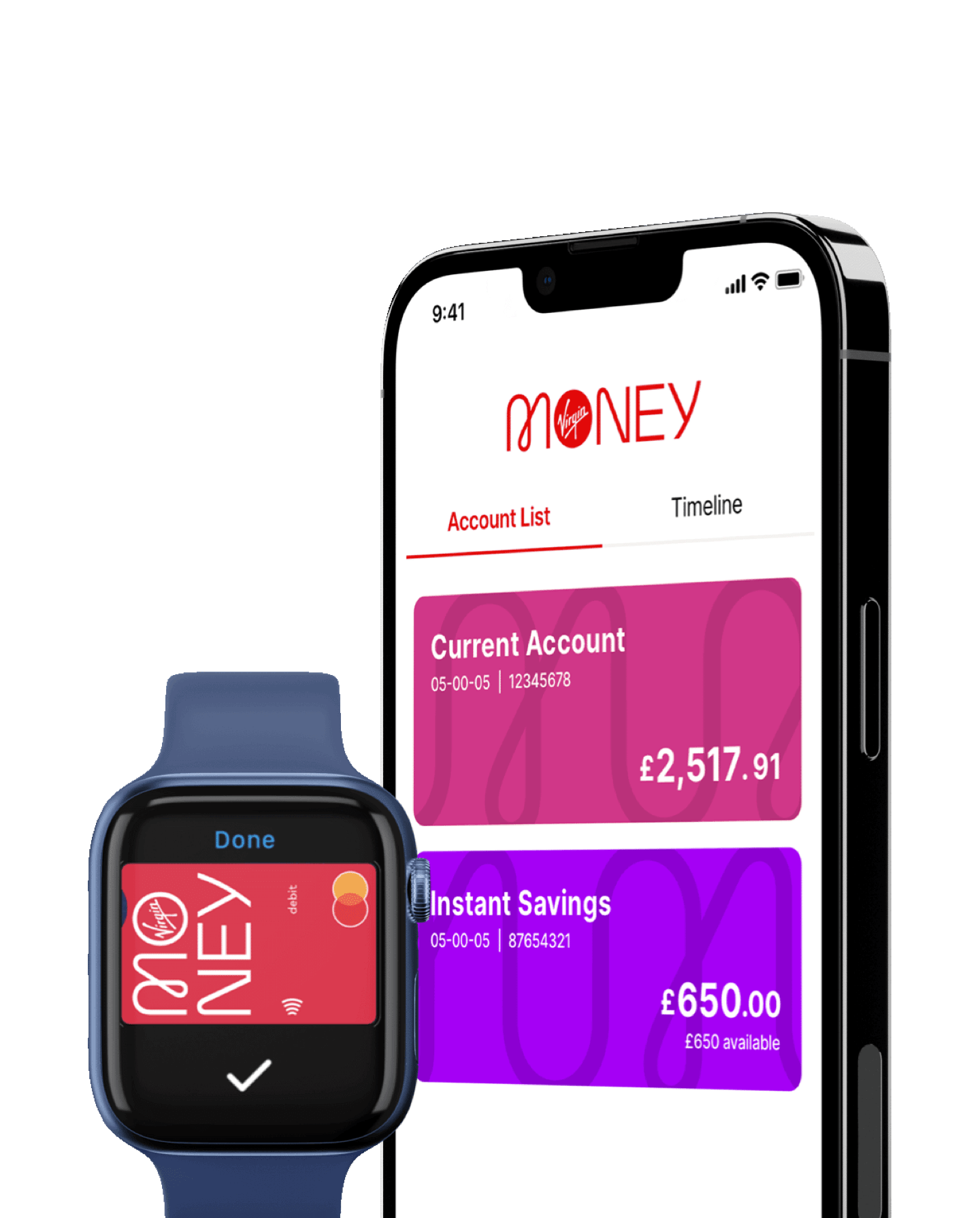

Be app-y

Get more from your current account with our banking app.

If you'd like to manage your money better this year, then take a look at what out app can do. It's packed full of clever features to help you pay, track, budget and save all in one place. Now doesn't that sound like a neat way to stay in control.

Our handy how to guides will get you up and running in the app. Find out how to set up a balance alert, view your statements, manage Direct Debits and more.

Not got the app? No worries. Simply download it and register your Debit Card to get going.

iOS 10 or above

Android 5.0 or above

Boost your digital know-how

Ask us your burning questions about the digital world and we'll help you master the basics.

Did you know, we offer free digital know-how sessions to help you boost your digital skills? From setting up or using mobile banking to staying safe online, and even video calls with the family, we’re here to help. Simply book a telephone or face-to-face appointment at a time that works for you.

Book an appointment

Clock up some cool cashback

Get money back in your hands when you shop with top brands this year.

Get rewarded for everyday spending with your current account from a selection of great brands. Simply register in the banking app by going to Discover > Virgin Money Cashback. Then check out the offers in the app, spend with your Virgin Money Debit Card and watch the cashback roll in. Terms apply3.

Get cashbackWhat a save

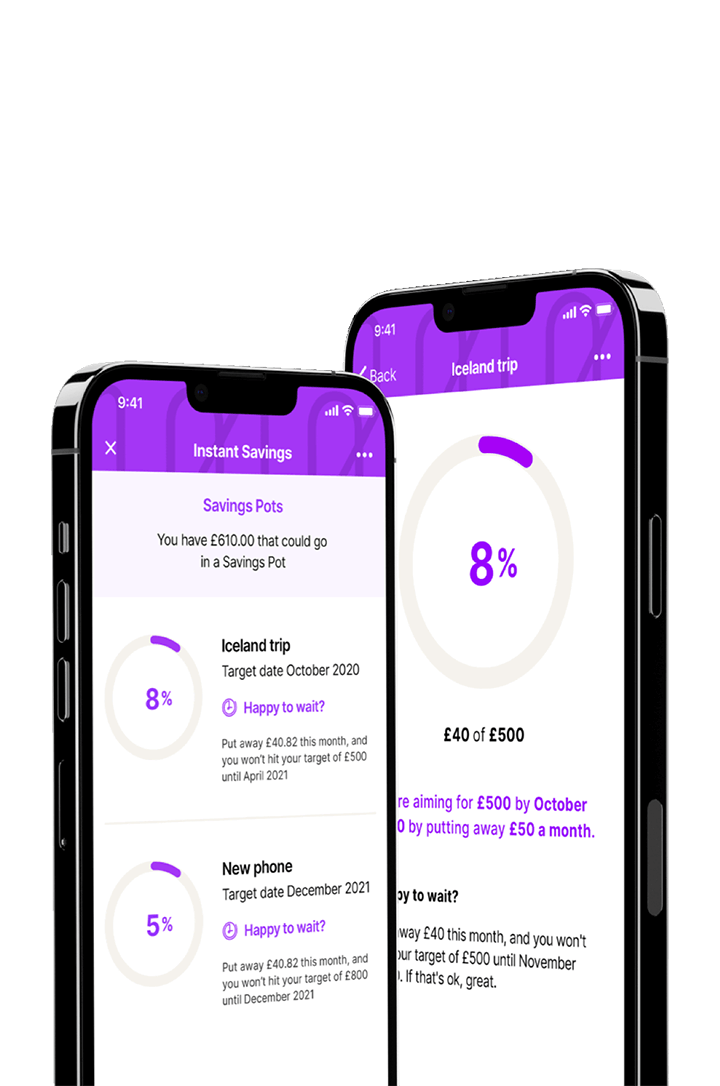

Whatever you're saving for in 2023, be sure to rack up your savings quicker with our red-hot savings rate.

- 2.50% AER4 on your savings Linked to our current account, the instant access saver pays a whopping variable 2.50% AER4 (2.48% Gross5 each quarter on savings up to £25,000).

- Enjoy instant access Pay money in and take it out again whenever you need to, without any fees or charges.

- Set your savings goals Set up Savings Pots in the app to help you save towards your savings goals.

Save cleverly using our app. Not got the app? No worries. Simply download and register it to start moving money into your Linked Saver and set up Savings Pots by selecting your Linked Savings Account > Savings Pots.

Get the app

Here for you in 2023

We know these are tough times. If you're worried about managing your money, check out our dedicated cost of living support page.

It's your one-stop shop for money-saving tips, help and free resources.

Get help and support

Brilliant tips, tricks and tools to help you and your money in 2023

Iona Bain, award-winning personal finance author is here to break down exactly how the Autumn budget will affect you – from energy bills to mortgages and benefits - plus, in each area of your finances, she’s offered three practical things you can do that could help manage your money in 2023.

Five tips to get you through the cost of living crisis

What help is out there if I’m struggling with my energy bills?

We asked Iona Bain, award-winning personal finance author, to put together an essential guide on the grants and payments that are available and where can you find extra support if you need it during this difficult time

How to give your money a makeover in 2023 – a month by month plan

Sorting out money matters can seem daunting but breaking it down into smaller goals is not only more manageable but makes them a lot more achievable. Check out our 2023 month-by-month guide to financial fitness.

Let’s talk about the ‘M’ word

Whether it’s with a friend, partner or your boss - talking about money can feel awkward and embarrassing. We spoke to the Money Medics to find out why it feels this way and how we can make money feel like less of a dirty word

It’s time to give your money a financial health check – here’s how

Carrying out a financial health check is important for staying in control of your money all year round. Read our essential tips on how and when to do them

[1] Insight is based on transactional spend activity on all Virgin Money personal current accounts between 1 January 2022 and 31 December 2022.

[2] The top five brands are based on a selection of well-known brands from the top spending category.

[3] Virgin Money Cashback is a customer cashback programme and the full Terms of the programme can be viewed here. You can get Virgin Money Cashback once you sign-up to the programme in your Virgin Money Mobile Banking app. If you have one or more current accounts with us, you’ll earn cashback on each eligible account and can view and manage your cashback as one total. With a joint current account, both account holders can sign up to Virgin Money Cashback via the Virgin Money Mobile Banking app, and you can each earn cashback on your spending with your own cashback account. Please note, some current account cashback offers are related to the account rather than any account holder, and so only one account holder will receive cashback on some offers.

[4] AER (Annual Equivalent Rate) illustrates what the interest rate would be if interest was paid and compounded once each year.

[5] Gross rate interest payable without taking account of any tax payable. Credit interest is calculated daily on the cleared credit balance in your account.