A UK general election and US presidential election is on the horizon. We look at how the stock market might respond. And what it means for investors.

Will a US presidential election affect my investments?

A US election will have an impact on global financial markets. Mainly in the run up to, and right after an election takes place.

Direct impacts on the UK stock market won’t be as intense as those felt in the US.

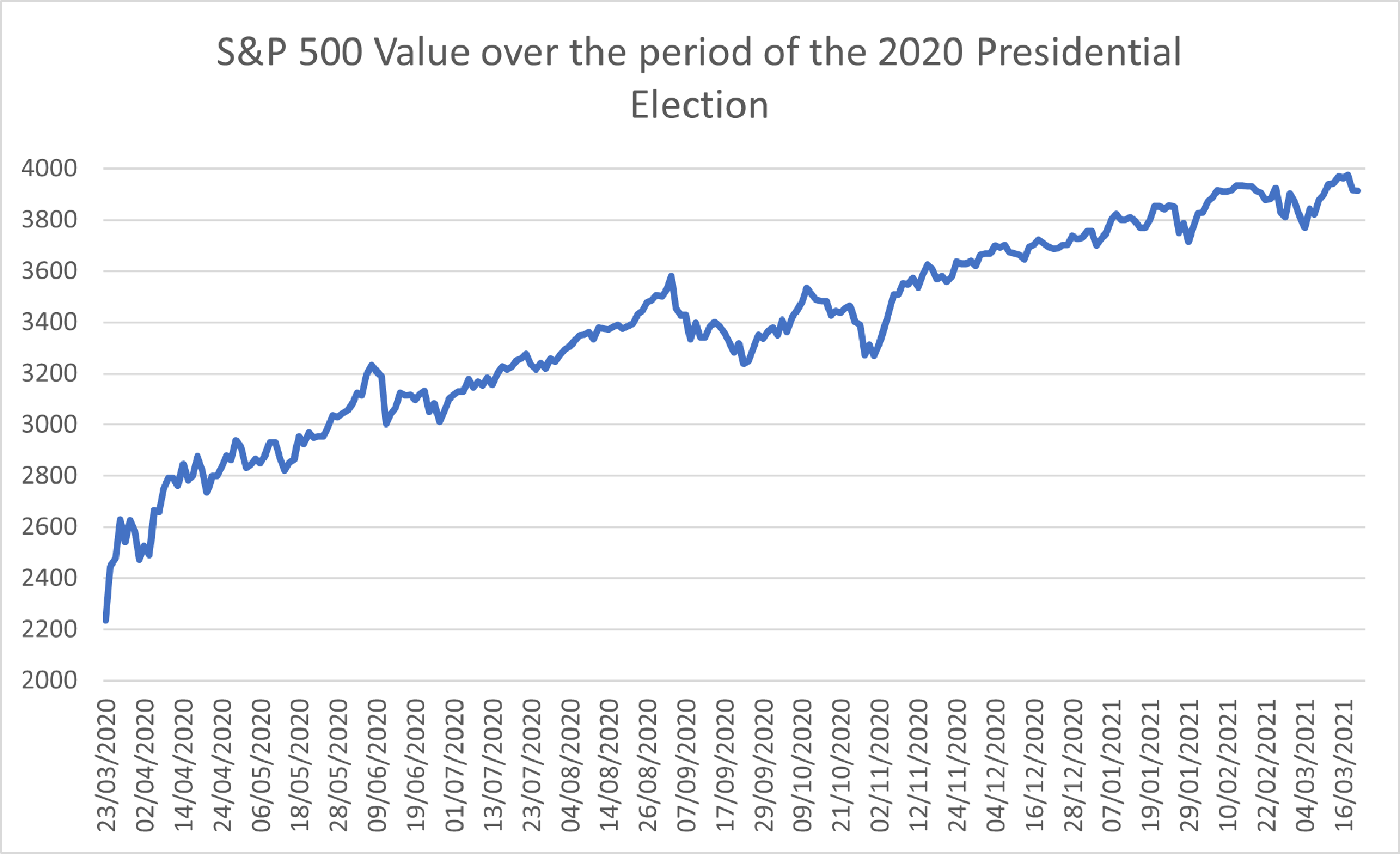

Historical data of the US market shows a dip during the election. As well as straight afterwards. But it’s then followed by a return to typical growth.

The majority of Virgin Money funds are invested worldwide, including in the US. They offer investors access to a broad range of markets and assets. This helps investors to stay diversified. Investors with diversified funds won’t be as affected as those who invest in the US alone.

So, why do markets historically take a small, short-lived hit?

1. Unpredictable Markets

Leading up to, and just after the 2020 US election, worldwide markets became more unstable.

There were a couple of reasons for this:

1. Uncertainty around who was going to be the next President.

2. Uncertainty of potential policy changes under a new government.

Different sectors of the market responded to the change differently. Resulting in sharp increases, or reductions, in stock prices.

The outcome of a presidential election has a knock-on effect across markets worldwide. This is because of international trade agreements and regulation.

There’s a good chance that we could also expect the future presidential election to have an impact on UK markets. But like in past elections, this may only be short-lived.

2. The performance of different sectors

Some sectors in the UK market can react more strongly to the US election results. For example, in 2020, renewable energy stocks saw a boost when Joe Biden was elected. This was largely because the Biden administration prioritised clean energy.

Similarly in 2016, non-renewable energy sectors thrived when Donald Trump focussed US government investment on the oil and gas sector.

3. Fluctuations in currency

Currency markets are the largest financial markets in the world. They are also affected by political change.

The value of the British pound will go up and down against the US dollar. Either before or just after a presidential election. This can increase or reduce the strength of the pound. As well as increasing or even reducing the cost of certain US assets to UK investors.

4. Long-term outlooks

Short-term movements in the UK stock market are likely. Especially during a US election.

But any long-term impacts are more likely to be caused by wider economic factors. Like inflation and interest rates. They are sometimes a result of new policies that can affect global markets. But they aren’t always immediately obvious.

Experienced investors are more likely to follow a relaxed approach during election time. They’re unlikely to make any knee-jerk reactions. Focusing instead on long-term strategies and growth.

How can a general election affect my investments?

General elections in the UK also have an impact on the market. This is because:

1. Any potential new Prime Minister (even if the same party stays in power) can shift priorities. Including in policies that affect the economy. Like tax, spending and cutting budgets.

2. A lack of trust in a new government, makes the wider market uneasy.

A recent example of this was when Liz Truss took office. The British pound weakened as a direct reaction to Truss’ leadership and policies. This created uncertainty in the market. And the result was a drop in the market. But the FTSE began to recover quickly after Truss announced her resignation.

So, why does this happen?

When there is doubt, there is often a higher feeling of risk.

Nervous investors might move their money out of UK assets. Because there’s a bit of uncertainty in their performance. Opting instead for, what they think, are stronger global economies. This leads to quite quick changes in the wider market. Especially if lots of investors are doing it at the same time.

But this isn’t always the best option. Because as we know, markets tend to recover over time. And investors could miss out by trying to buy or sell assets quickly.

Investors might try to guess what the market might do in the future. And then make investment decisions based on their prediction. It’s sometimes called “timing the market”. But they might actually end up missing out in the end.

Tips for investors in an election year

There’s lots of global political uncertainty in 2024. It’s not common for the UK and the US to both face an election in the same year. So, investors might feel the sting a little more. But it shouldn’t influence any long-term goals.

Here’s some tips for keeping your cool in a double election year:

- Don’t make hasty decisions

Especially in the run-up to and immediately after an election. Staying calm and collected generally has a more positive impact on investors’ returns. - Preparation can help calm any fears

The market is likely to make quite significant movements during an election. Being prepared for it to happen is half the battle. Investors can decide to buy into the market gradually during this time. This can help them take advantage of pound-cost-averaging.

Jargon Buster! Pound-cost averaging is an investment strategy. Investors put their money into the stock market regularly over time. Rather than in one big lump every so often. It can help to calm the up and down of the stock market on your money.

Example:

You want to invest £1,200 by the end of the year. So, you decide to invest £100 every month.

Month 1: You invest £100 when the average stock price is £10 per share, you have 10 shares.

Month 2: You invest £100 when the average stock price is £8 per share, your £100 buys 12.5 shares.

Month 3: You invest £100 when the average stock price is £12 per share, your £100 buys 8.3 shares.

And so on for the following 9 months.

By the end of the 12 months, you’d buy more shares when the prices are low and fewer when prices are high. It helps to spread out risk and take advantage of market fluctuations. Without trying to time the market.

Where to next?

- Read our latest market update to stay in the loop.

- Need a technical jargon buster? We’ve got you covered