The highlights

- Exclusive offers

- Unlock exclusive accounts, rates and offers. Like a child bank account for 11 to 15s. Explore our exclusives.

- Boost your balance

- Grab 1.00% AER/grossRates are variable. Interest paid monthly. interest on your current account balance up to £1,000.

- Super savings

- This account comes with a free linked saver account called the M Plus Saver. Get 2.00% AER/1.99% grossRates are variable. Interest paid quarterly. interest on a balance of up to £25,000. 1.50% AER/1.49% grossRates are variable. Interest paid quarterly. on balances above £25,000.

- This rate applies from 3 November 2025. Until then, you'll earn 2.25% AER (2.23% gross per annum variable) on balances up to £25,000 and 1.75% AER (1.74% gross), on any balances above £25,000. Find out more about our rate change.

- No fees overseas

- We won't charge you for spending on your card or withdrawing cash when you're abroad. Just so you know, some ATMs might charge a fee.

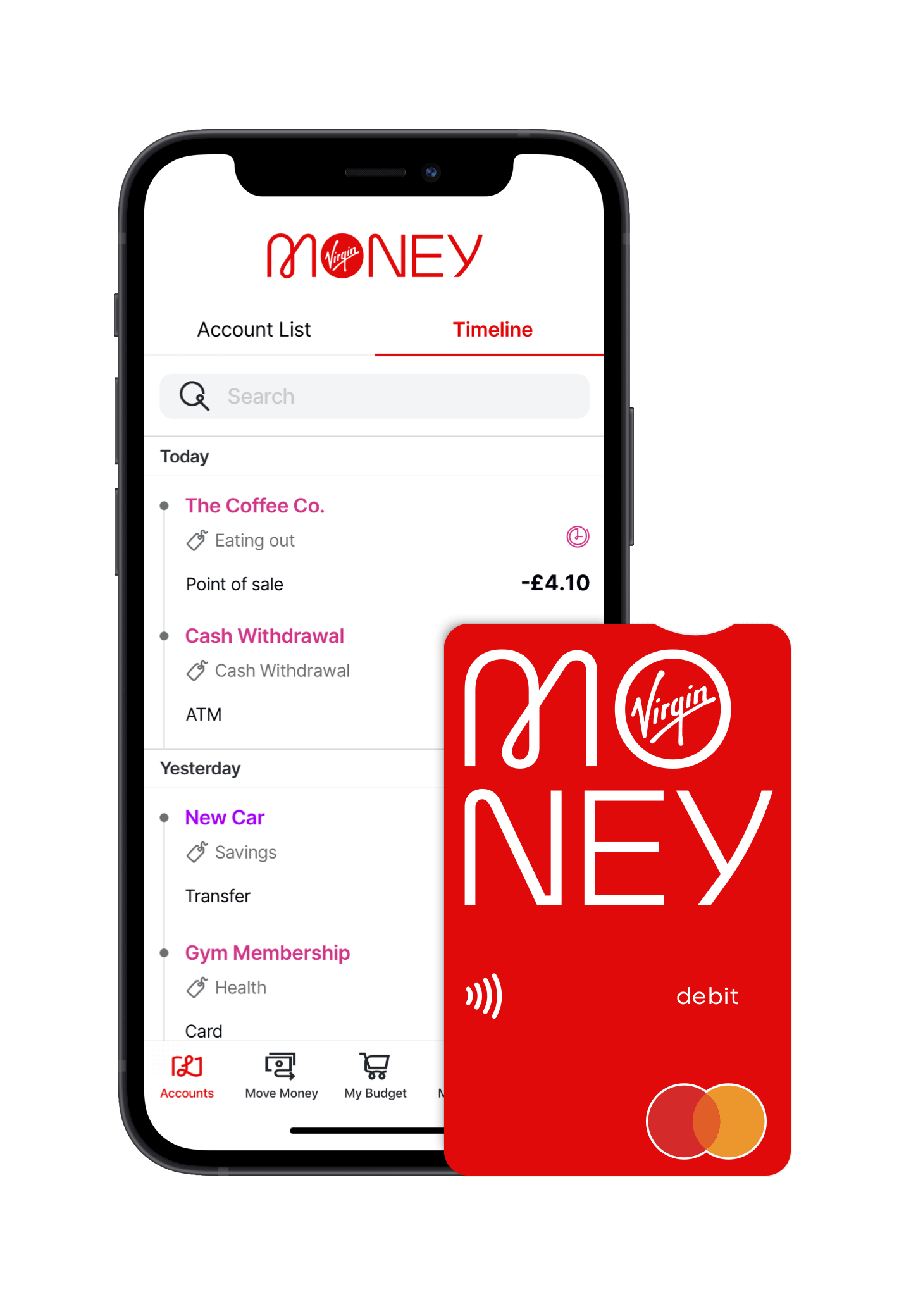

- Cool cashback

- Earn money while you spend, from well-known brands to our own travel insurance. Check the app for latest offers, and then watch your balance build.

Good to know

Switch your current account

Switch your account to us in less than 7 days. It’s easy, we do all the work, and it's backed by the Current Account Switch Guarantee.

Protecting your money

Sleep easy with protection on deposits up to £85,000. Provided through the Financial Services Compensation Scheme (FSCS).

Looking for an overdraft?

If there are times you might need to borrow a bit of money, you could get an overdraft. Find out how much it might cost and check your eligibility.

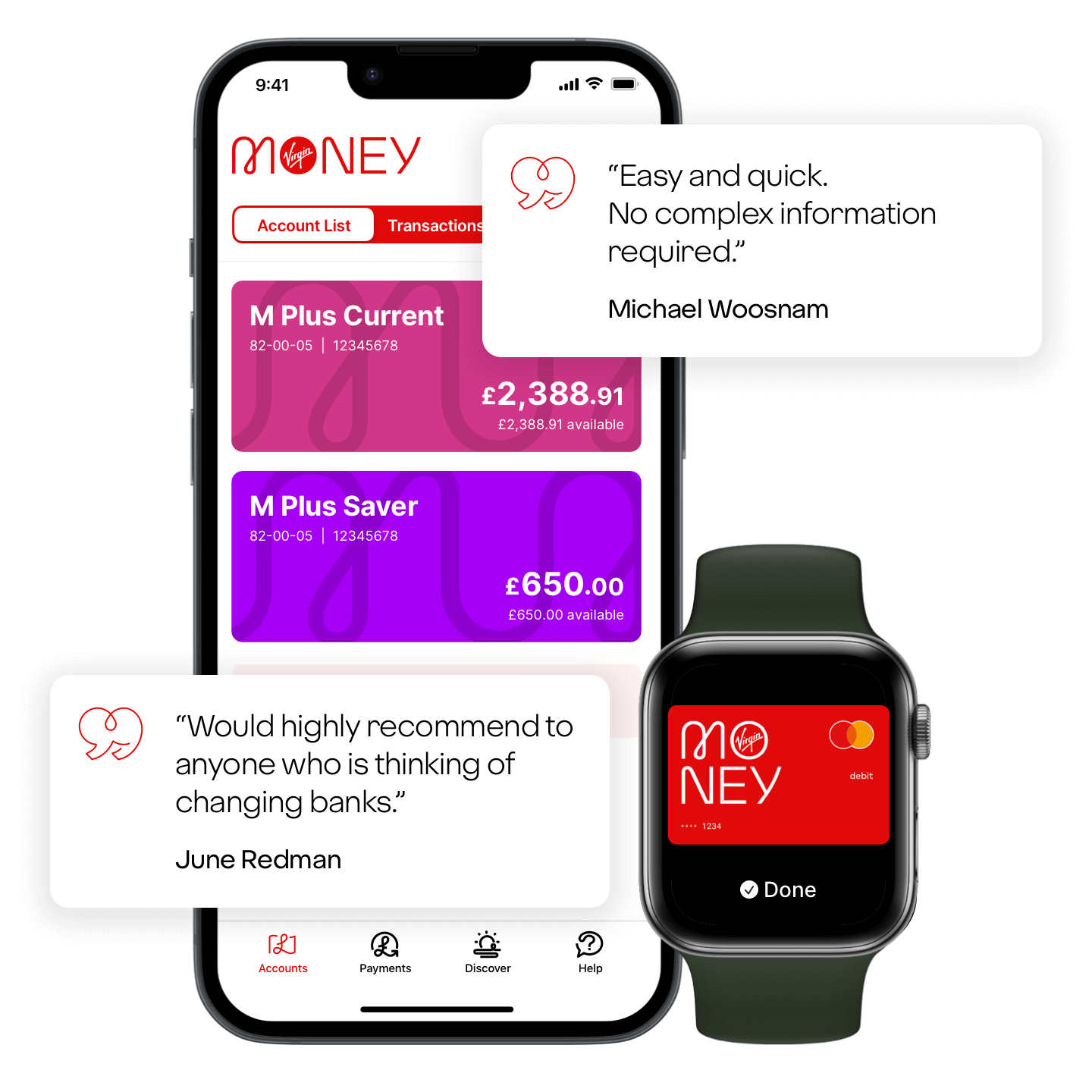

Get the lowdown on the linked saver

It’s quick to transfer money between your current account and linked saver account. And if you use the app or online banking, you can see the balances whenever you want.

Check out the M Plus Saver summary box:

Interest rate until 2 November 2025

| Balance | Gross rate (%) | AER (%) |

|---|---|---|

| Balances up to and including £25,000 | 2.23% | 2.25% |

| Balances over £25,000 | 1.74% | 1.75% |

Interest rate from 3 November 2025

| Balance | Gross rate (%) | AER (%) |

|---|---|---|

| Balances up to and including £25,000 | 1.99% | 2.00% |

| Balances over £25,000 | 1.49% | 1.50% |

Interest is calculated on a daily basis and paid on the last working day of each calendar quarter.

Yes, if we decrease your rate we’ll provide at least two months’ notice as described in your Terms. We may increase your rate without giving you notice

Estimated balance until 2 November 2025

| Initial deposit at account opening | Balance after 12 months |

|---|---|

| £1,000.00 | £1,022.50 |

| £25,000.00 | £25,561.18 |

| £50,000.00 | £50,999.01 |

Estimated balance from 3 November 2025

| Initial deposit at account opening | Balance after 12 months |

|---|---|

| £1,000.00 | £1,020.05 |

| £25,000.00 | £25,500.31 |

| £50,000.00 | £50,874.90 |

This is only an example and doesn't take into account your individual circumstances.

The example assumes that:

- no further deposits or withdrawals are made;

- any interest earned stays in the account; and

- there is no change to the interest rate.

You may only open an M Plus Saver if you have an M Plus Account with us in the same name(s). The M Plus Saver will stay open, as long as the M Plus Account is maintained as described in the Terms.

The account can be opened in Branch or online, virginmoney.com/current-accounts/pca, or call us on 0800 121 7365, someone from our team will be available 24/7.

There are no minimum or maximum balance restrictions or need to pay in on a regular basis. The M Plus Account is available to anyone from the age of 16. Subject to status.

If you want to apply online, you'll need to be at least 18. Subject to status.

You may only withdraw funds by transfer to your M Plus Account or any other account that we allow you to make a transfer into using online/telephone banking, the Virgin Money Mobile Banking app or in Branch.

If you apply for an account, you’ll need to download and read these documents:

Interest explained

- AER stands for Annual Equivalent Rate, and illustrates what the interest rate would be if interest was paid and compounded once each year.

- APR stands for Annual Percentage Rate. If you have a credit card, the APR is the cost of using your card to borrow money over a 12 month period.

- Credit interest is calculated daily on the cleared credit balance in your account.

- Gross is the interest payable without taking account of any tax payable.

- p.a. stands for per annum, which means every year.

- The tax-free rate is the contractual rate of interest payable where interest is exempt from income tax.