Explore your options

Learn about pensions

One pension, two easy options

Currently, with this product you can only access your pension money as a lump sum from age 55 (57 from 2028). So if you're looking for flexible access, this might not be the pension for you.

Navigator

Steered automatically based on your age

- We make the choices and investment decisions

- We'll keep an eye on things, so you don't have to

- A good option if you want to take money from your pension in retirement, whilst keeping it invested

Self-Drive

You steer your own pension choices

- You choose which investment approach is right for you

- You keep an eye on your pension (we still do the investing)

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

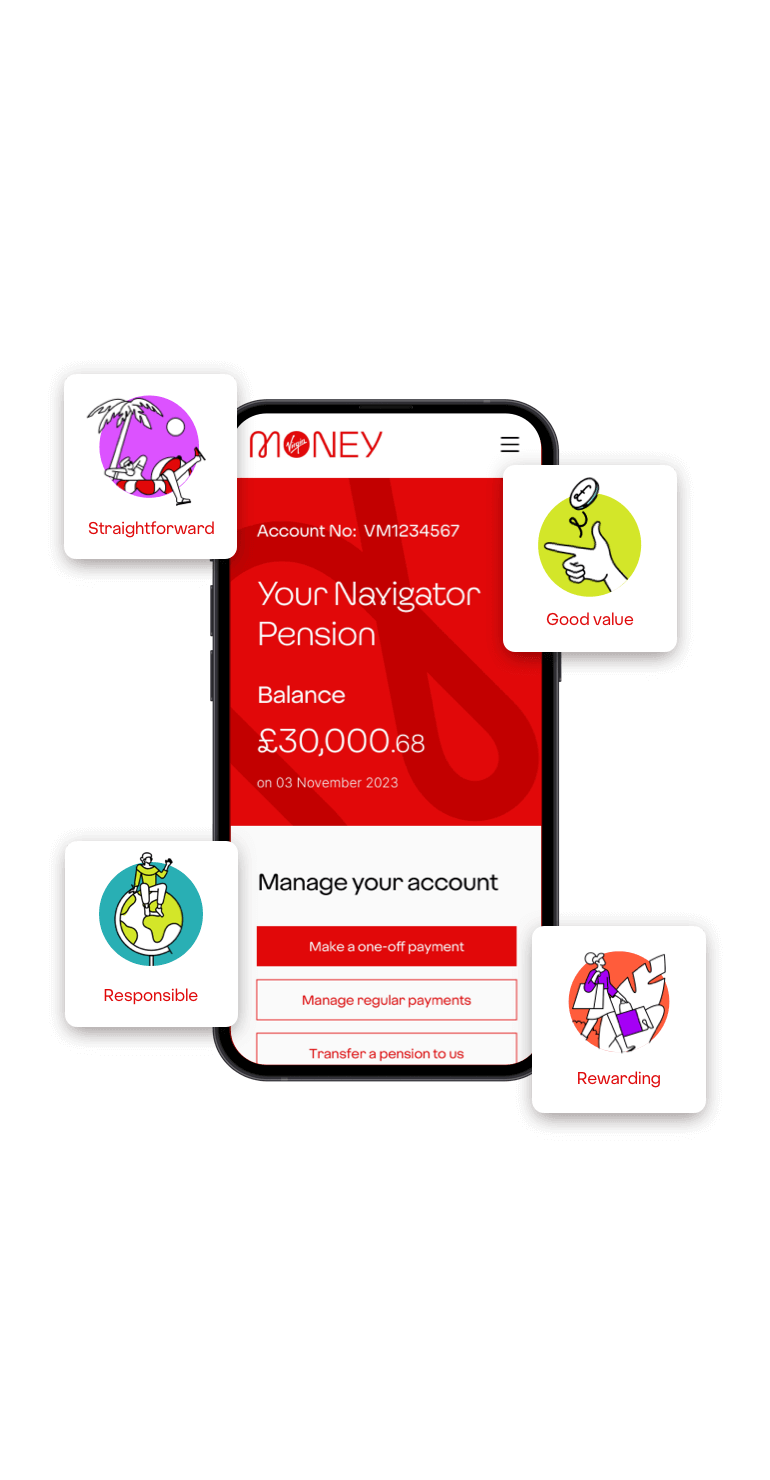

Why choose a Virgin Money Pension

Our personal pension helps you plan for a brighter future with two super-smart and straightforward choices to grow your money.

Start from £25 a month

or move your pensions to us.

- Straightforward

- No jargon, no waffle, we make pensions simple.

- Good value

- Our experts invest your money worldwide to reduce risk and help it grow, at a fair price.

- Responsible

- We make investment decisions that consider people and the planet.

- Rewarding

- Treat yourself with rewards from the Virgin family and beyond.

Currently, with this product, you can only access your pension money as a lump sum from age 55 (57 from 2028). So, if you’re looking for flexible access, this might not be the pension for you.

Imagine your retirement

Our retirement tool will help you understand the income you'll need for the retirement of your dreams.

Use our retirement plannerLearn about pensions

Find out everything you need to know about pensions with handy tips, guides and videos from our pensions experts.

Check it out