A new home for investments and pensions

Our investments and pensions business is being sold to Octopus Money, subject to approval by the Financial Conduct Authority (FCA).

Read moreWelcome to brighter investing

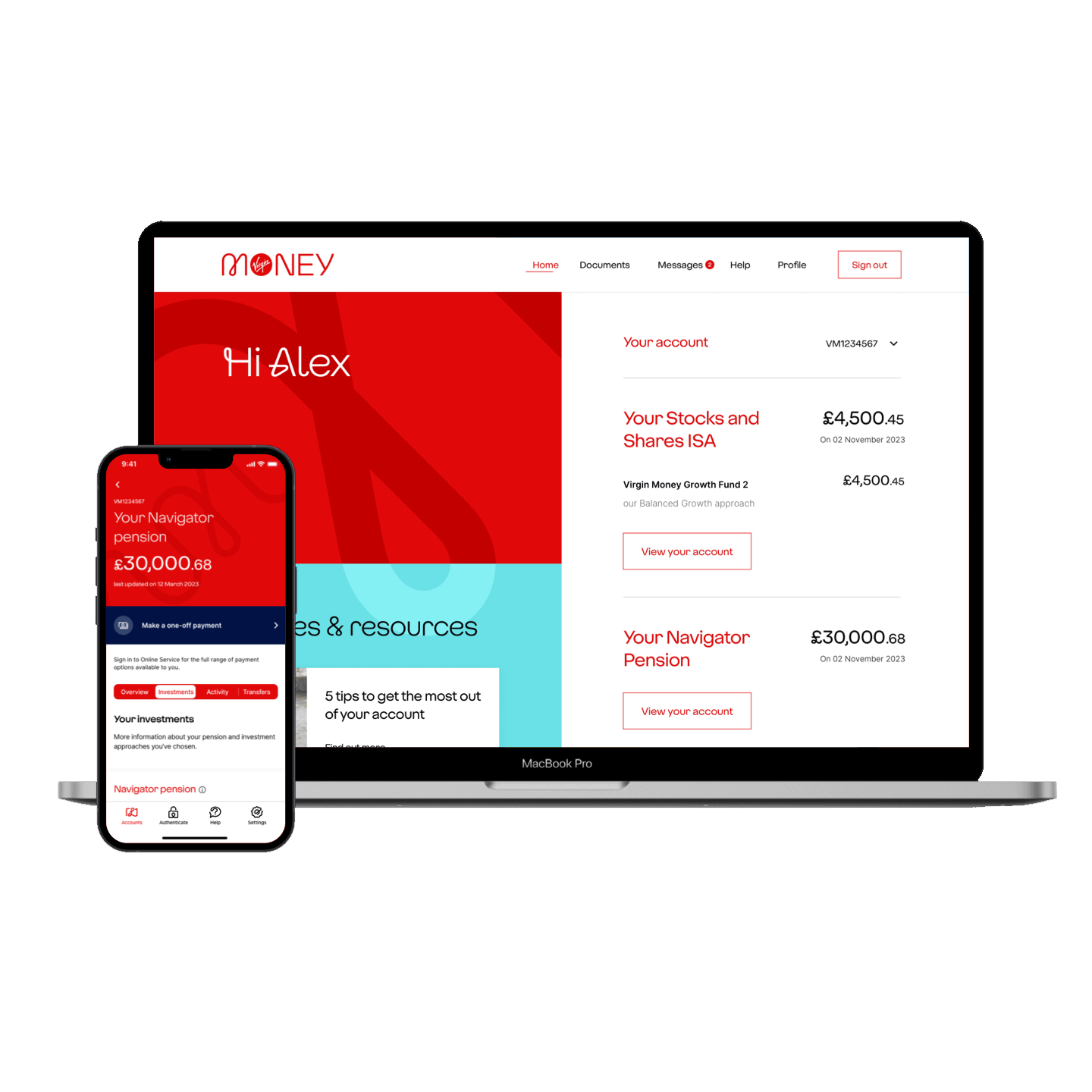

If you opened your account before January 2023, you can now manage it with our improved Investments and Pensions Online Service. With the option to go paperless. More features, more security, less hassle.

Find out how you can have an improved online service

Accounts, funds and charges

Terms and charges

Download and view the latest key features and terms for your Pension.

Our funds

Take a look at our funds and how they've performed.

Key Investor Information

Download and view the latest Key Investor Information documents for our funds.

Fund Value Assessment

An evaluation of our funds' value for money and performance.

Questions and answers

Yes, our Navigator pension is the hands-off way to manage your pension. We adjust your pension automatically based on your age, focusing on growth when you’re young and stability as you get older.

If you've got a pension but can't remember all the details, the first thing to do is contact your pension provider- if you know who it is. Your previous employer could help if it was a pension they helped arrange. Follow our top tips to find your pension.

There’s no limit to how much you and your employer (if you have one) can pay into your pension. There is, however, a limit to how much of those payments can benefit from tax relief.

Most employed people can get tax relief on pension payments up to either 100% of their salary or a gross annual allowance of £60,000 which includes payments and tax relief – whichever is lower. This amount can be higher if you have unused allowance from past tax years. You may have a lower limit if you earn a lot or have already accessed your pension benefits. Even if you don’t pay income tax, you’ll still get tax relief on the first £2,880 you pay in each year.

For more info see gov.uk

Yes, other people, including your employer, can also pay into your pension. To arrange for another person or employer to make a payment you’ll need to call us.

Bear in mind that you can't benefit from income tax relief on pension payments that come directly from your employer. Also, please note that your employer making payments into the Virgin Money Pension can't use this as an approved Auto-Enrolment (workplace) pension scheme to make payments.

Read all about it

Investment market updates

Read the facts about what's been influencing investment performance over the past 12 months.

Investment topics

Our experts dig a little deeper into the key trends and topics influencing investment performance.