What's happened

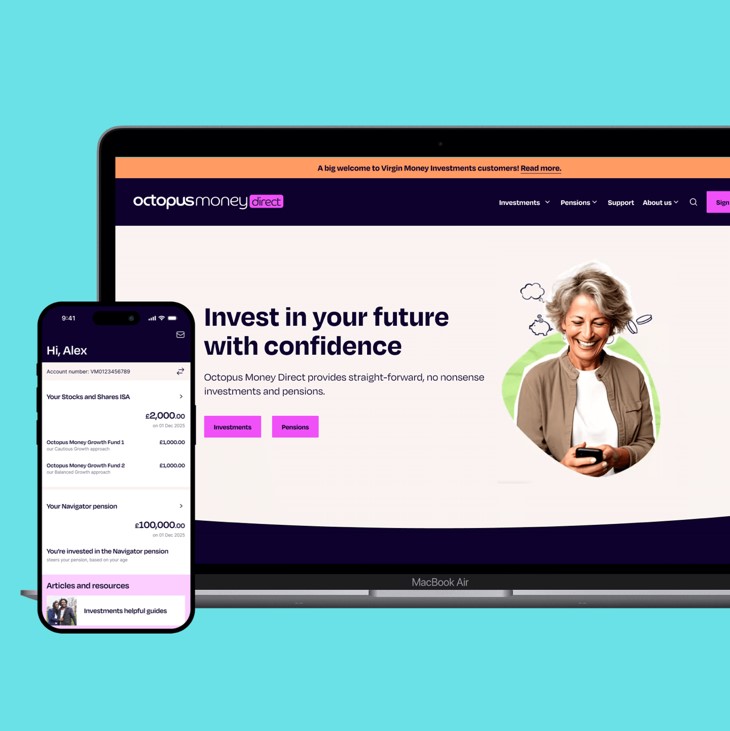

Virgin Money Stocks and Shares ISAs, Investment Accounts and Pensions are now with Octopus Money Direct.

Other Virgin Money products and services are not affected.

Go to Octopus Money Direct Link opens in a new window

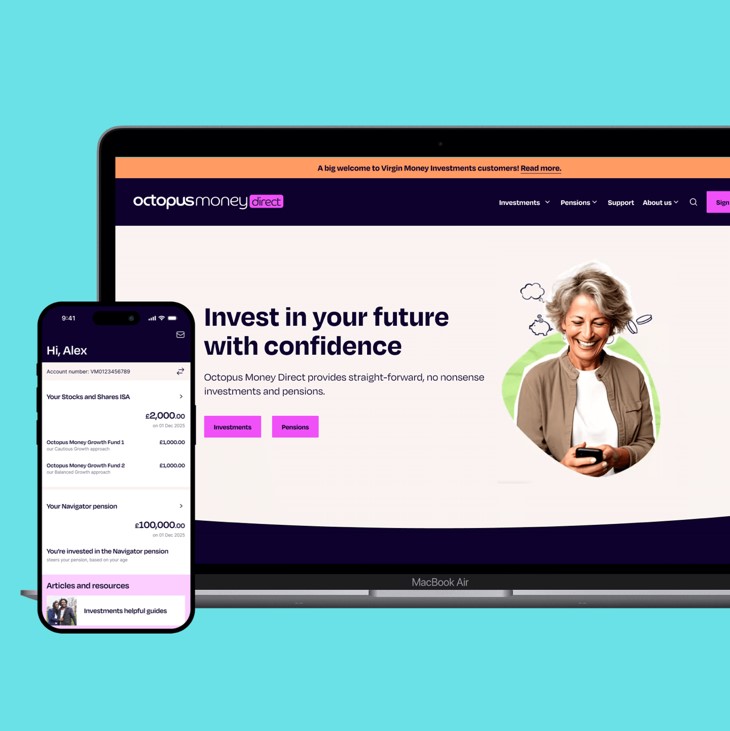

Virgin Money Stocks and Shares ISAs, Investment Accounts and Pensions are now with Octopus Money Direct.

Other Virgin Money products and services are not affected.

Go to Octopus Money Direct Link opens in a new window