What is a 0% balance transfer?

A balance transfer allows you to move part or all of the balance from other credit or store cards to your Virgin Money or Virgin Atlantic credit card.

With a 0% balance transfer you’ll then pay it off at 0% interest for a set period of time. Then you will move to your standard interest rate. A transfer fee will apply.

A 0% balance transfer can help you

- Save on interest

If you’re paying interest on a credit or store card, moving to a 0% balance transfer means you’ll pay zero interest. This saves you money and could help you become debt free faster.

- Get things organised

A balance transfer to your Virgin Money or Virgin Atlantic credit card can help you organise your debt in one place, making it easier to manage and keep track of.

- Consolidate your payments

Instead of making several monthly payments to different cards, when you transfer these balances to one card, you’ll only have one monthly payment to make.

Top tips

- Transfer high interest cards first

- This should save you money on interest. You can transfer as many cards as you need, but the total you transfer cannot be more than 95% of your credit limit.

- Pay off your debt faster

- It's best to try and pay as much as you can afford each month. Paying only the minimum payments may take longer and cost more to repay. Setting up a Direct Debit is the best way to stay on track.

- If you need some cash

- Our balance transfer credit cards come with a money transfer option. You can check your eligibility to see if you’d be offered a promotional rate and fee.

What is a money transfer?

A money transfer lets you move money from your Virgin Money Credit Card to your bank account.

- As an example, if your credit card limit is £5,000

- You can transfer up to 95% of that credit limit to your current account

- That’s a boost of £4,750 into your current account

A money transfer can help you

- Pay for bigger purchases

A money transfer can pay for one-off bigger buys like a car, holiday or some home improvements.

- Get money quickly

Pay for unexpected expenses such as vet bills, car repairs or replacing home appliances with a money transfer.

Key information

If you decide that a balance or money transfer is right for you, there's a few things to be aware of:

- Fees apply

- We charge a one-off transfer fee for making a balance or money transfer. The fee is a percentage of the total amount transferred.

- Promotional rate

- New customers may be offered an introductory promotional rate and fee. This applies to money or balance transfers made within 60 days of account opening. Existing customers may be offered promotional rates, see your offer for details.

- When a promotional offer ends

- We charge the standard interest rate when a promotional offer for a balance or money transfer ends, or is withdrawn. If you miss a minimum monthly payment, the promotional offer will be withdrawn. After this, we’ll charge the standard interest rate.

- Already bank with us?

- You cannot transfer a balance from another Virgin Money credit card. You should not use a money transfer to repay other borrowing from Virgin Money.

Ready to transfer?

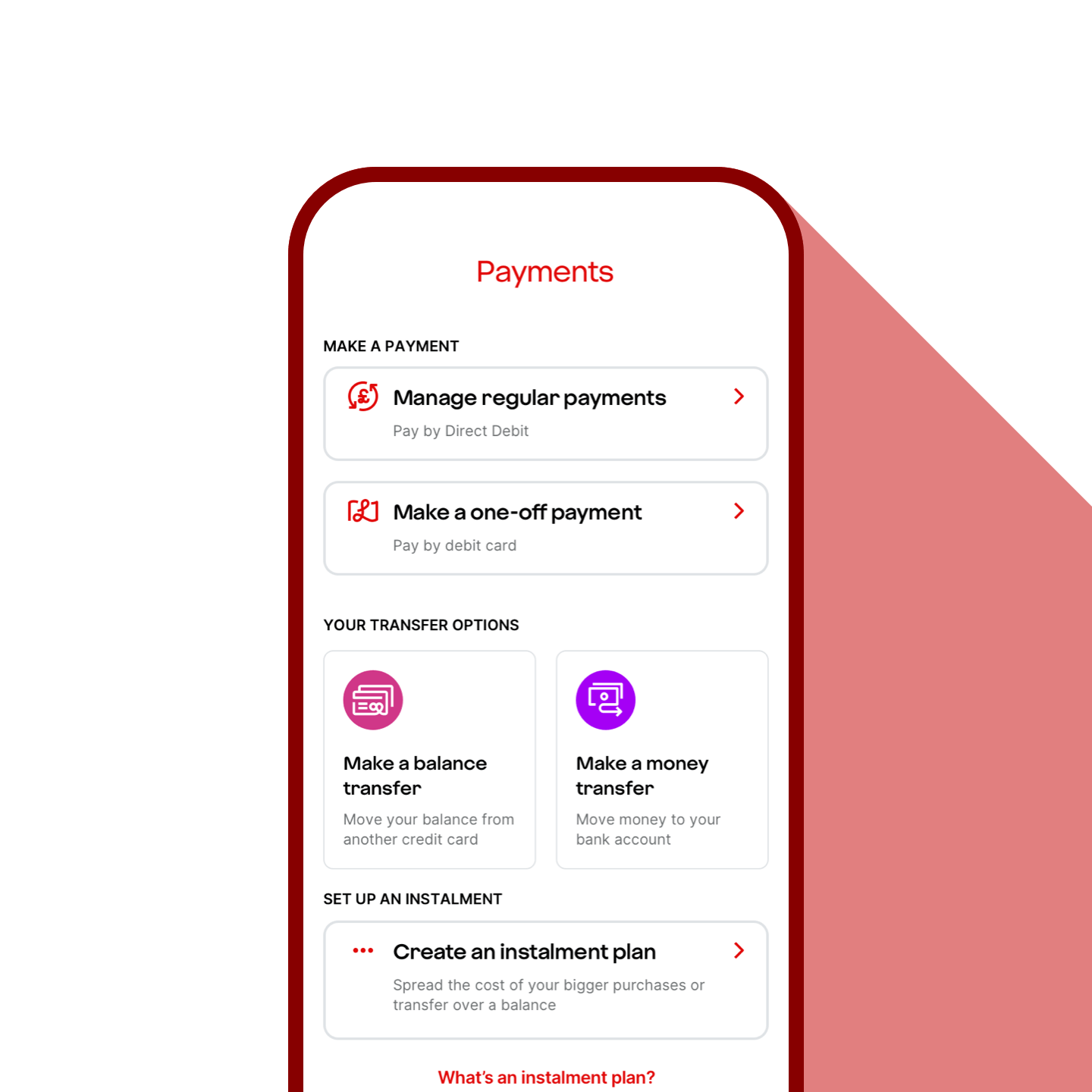

Once you have your Virgin Money credit card it's easy to make a balance or money transfer in the app.

- Head to the Virgin Money credit card app

- Go to the payments section

- Tap ‘Make a balance transfer’ and/or ‘Make a money transfer’ and follow the steps

The money will be in your account within 3 days if no extra checks are needed.

Check your eligibility

Want a Virgin Money credit card? Use our card checker

- know your chances of being accepted

- you'll see your minimum credit limit on pre-approved cards

- it won't affect your credit score

To manage your card, you'll need the Virgin Money Credit Card app.

Check your eligibility