Create a savings habit for life

Getting your child their own savings account can kickstart their saving and make it a habit they’ll stick to as they grow up.

Saving small amounts from their birthday or pocket money will soon add up. You and other family members can also add to the funds, you could even set up a standing order to their account.

There’s lots of choice for savings accounts for children. In the market you’ll come across accounts such as junior ISAs, easy access and regular savers.

At Virgin Money we offer a child bank account that comes with a linked saver account.

Virgin Money M Power Account

M Power Account is our child bank account and is free to use. Your child gets a proper bank account with their own debit card and app. You get peace of mind as you can see when, where and how much they’re spending.

They’ll also get a linked saver account. It’s a great way to start saving as it’s quick to transfer funds between their current and savings account in our app.

They’ll also benefit from:

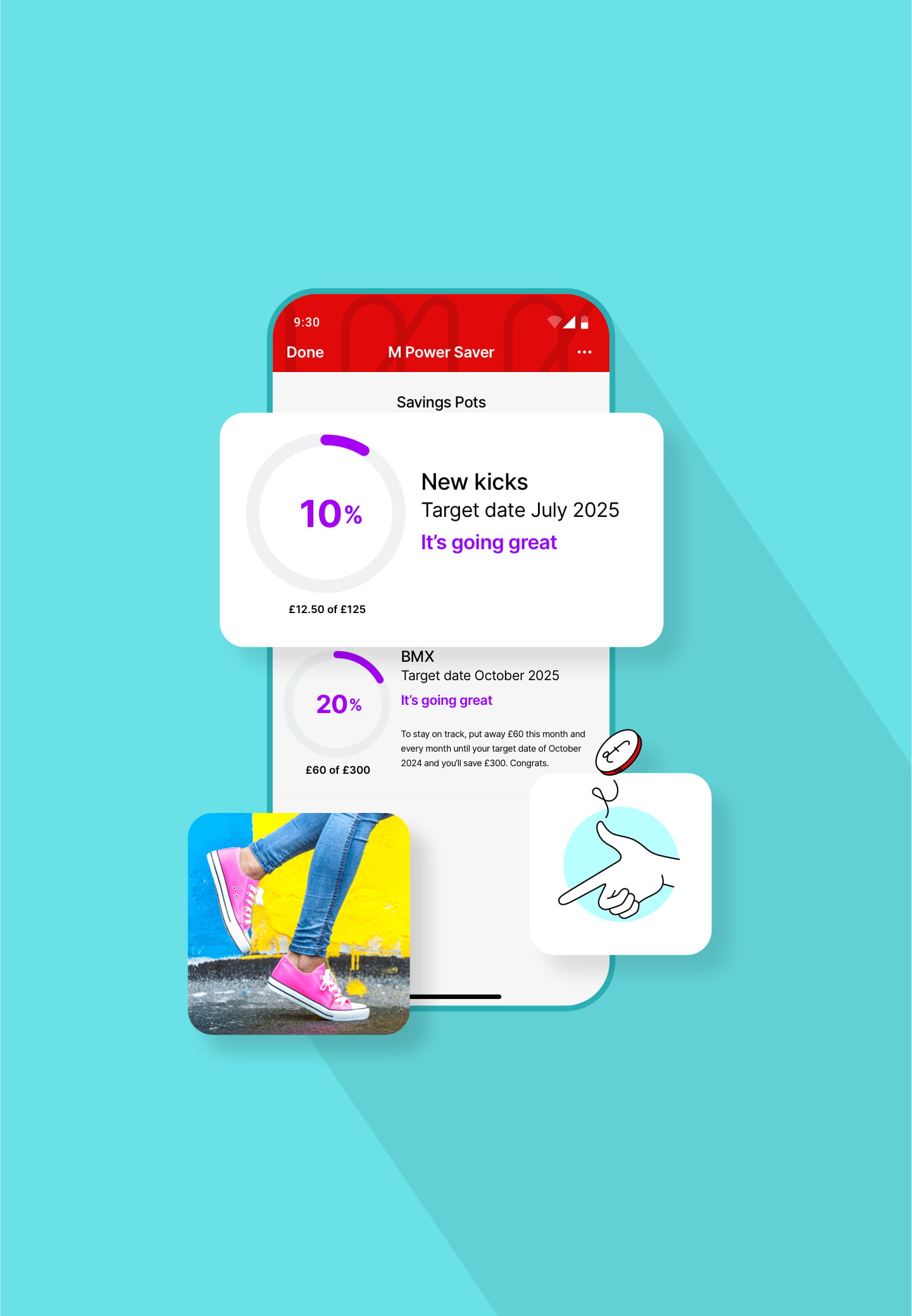

Savings Pots

They create it, name it and set how much they want to regularly put into it. ‘New kicks’ - sorted!

Rewarding rates

Kids can grow their savings with 2.25% AER(2.23% gross p.a. variable). Interest paid quarterly. on balances up to £25,000, and 1.75% AER(1.74% gross p.a. variable). Interest paid quarterly. on balances above £25,000.

They’ll also earn 1.00% AER(1.00% gross p.a. variable). Interest paid monthly. on their current account balance up to £1,000.

Explore our child bank account

Savings with Virgin Money are covered up to £85,000.