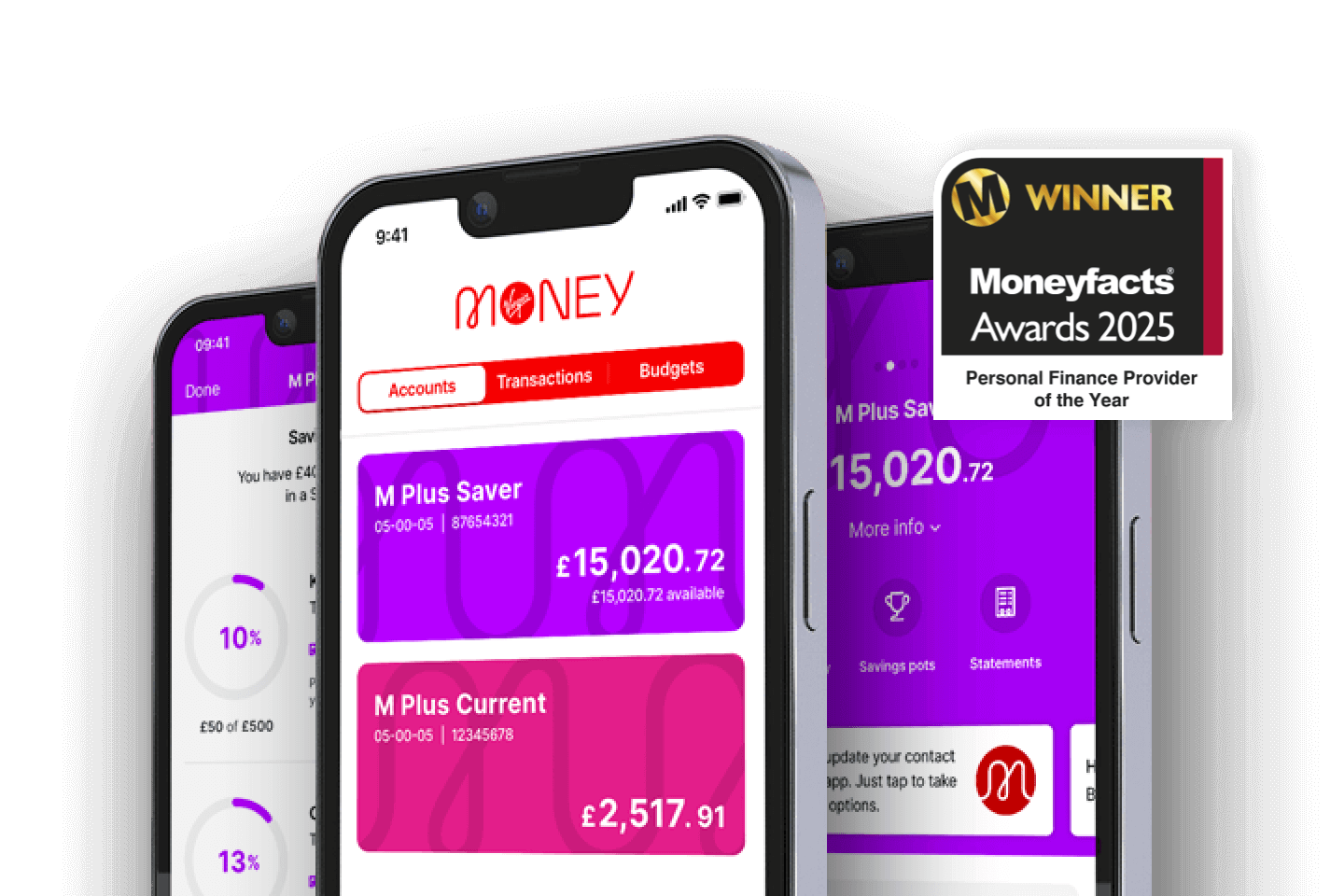

Virgin Money

M Plus Saver

Our exclusive Linked Savings Account for M Plus Current Account customers.

One of our best rates available for current account savers

M Plus Saver

1.75%

AER1 (1.74% gross2 per annum variable) on savings balances up to £25,000, and 1.25% AER1 (1.24% gross2) on any balances above £25,000. Interest paid quarterly.

This rate applies from 30 March 2026. Until then, you'll earn 2.00% AER1 (1.99% gross2 per annum variable) on balances up to £25,000 and 1.50% AER1 (1.49% gross2), on any balances above £25,000. Find out more about our rate change.

- Freedom to pay money in and take it out whenever you want, with no fees or charges

- Start saving straight away - there's no minimum pay-in amount

- Feel the love with exclusive rewards from the linked M Plus Account

Savings that work as hard as you do

Introducing the M Plus Saver - our most flexible way to save. Start saving with as little as you like, and earn 1.75% AER* on balances up to £25,000.

- Enjoy instant access

- Pay money in easily and access it whenever you like - there are no fees or charges to worry about.

- Savings that add up

- Watch your money grow with in-credit interest on your current account and linked savings account.

- Set your savings goals

- Pick a goal, create a Savings Pot for it, and transfer money into it when you can.

* 1.75% AER1 (1.74% gross2 per annum variable) on savings balances up to £25,000, and 1.25% AER1 (1.24% gross2) on any balances above £25,000. Interest paid quarterly. This rate applies from 30 March 2026. Until then, you'll earn 2.00% AER1 (1.99% gross2 per annum variable) on balances up to £25,000 and 1.50% AER1 (1.49% gross2), on any balances above £25,000. Find out more about our rate change.

With an M Plus Saver you'll also get...

A free and easy-to-use M Plus Account. Our most popular current account comes with an interest rate that hits the high notes. Earn 1.00% AER* on balances up to £1,000.

- Virgin Money rewards

- We've got epic rewards for everyone. Brighten up your world with exclusive offers in our app.

- Money back in your hands

- Earn cashback on your shopping when you spend with participating retailers.

- No fees when you travel

- We won't charge you for using your card or withdrawing cash when abroad.

* 1.00% AER1 (1.00% gross2 per annum variable) interest rate, paid monthly, on your M Plus Account balance up to £1,000.

You're ready to apply if:

- You're 18 or over and live in the UK (over 16s can open an account in Store).

- You've read the terms, tariff and other important information below.

Account name

M Plus Saver

What is the interest rate?

Interest rate until 29 March 2026

| Balance | Gross rate (%) | AER (%) |

|---|---|---|

| Balances up to and including £25,000 | 1.99% | 2.00% |

| Balances over £25,000 | 1.49% | 1.50% |

Interest rate from 30 March 2026

| Balance | Gross rate (%) | AER (%) |

|---|---|---|

| Balances up to and including £25,000 | 1.74% | 1.75% |

| Balances over £25,000 | 1.24% | 1.25% |

Interest is calculated on a daily basis and paid on the last working day of each calendar quarter.

Can Virgin Money change the interest rate?

Yes, if we decrease your rate we’ll provide at least two months’ notice as described in your Terms. We may increase your rate without giving you notice

What would the estimated balance be after 12 months based on:

Estimated balance until 29 March 2026

| Initial deposit at account opening | Balance after 12 months |

|---|---|

| £1,000.00 | £1,020.05 |

| £25,000.00 | £25,500.31 |

| £50,000.00 | £50,874.90 |

Estimated balance from 30 March 2026

| Initial deposit at account opening | Balance after 12 months |

|---|---|

| £1,000.00 | £1,017.52 |

| £25,000.00 | £25,437.03 |

| £50,000.00 | £50,748.48 |

This is only an example and doesn't take into account your individual circumstances.

The example assumes that:

- no further deposits or withdrawals are made;

- any interest earned stays in the account; and

- there is no change to the interest rate.

How do I open and manage my account?

You may only open an M Plus Saver if you have an M Plus Account with us in the same name(s). The M Plus Saver will stay open, as long as the M Plus Account is maintained as described in the Terms.

The account can be opened in Branch or online, virginmoney.com/current-accounts/pca, or call us on 0800 121 7365, someone from our team will be available 24/7.

There are no minimum or maximum balance restrictions or need to pay in on a regular basis. The M Plus Account is available to anyone from the age of 16. Subject to status.

If you want to apply online, you'll need to be at least 18. Subject to status.

Can I withdraw money?

You may only withdraw funds by transfer to your M Plus Account or any other account that we allow you to make a transfer into using online/telephone banking, the Virgin Money Mobile Banking app or in Branch.

Additional Information

Interest will be paid gross.

Gross rate interest is the interest payable without taking account of any tax payable.

AER (Annual Equivalent Rate). The Annual Equivalent Rate illustrates what the interest rate would be if interest was paid and compounded once each year.

An Arranged or Unarranged Overdraft is a way to borrow money from us and is intended for occasional use. Here's a quick overview of how they work:

Arranged Overdraft

This is a borrowing limit on your account that we agree with you in advance, so it's there when you need it. You'll pay Arranged Overdraft interest on the amount you choose to use.

Unarranged Overdraft

This is where you borrow from us when there is no money left in your account (or when you have gone past your Arranged Overdraft limit) and this has not been agreed with us in advance. You will pay Unarranged Overdraft interest.

If you don't have enough money in your account to cover a payment, we may charge a Refusing A Payment Due To Lack Of Funds Fee. You should aim to repay your overdraft borrowing as quickly as possible and use it responsibly as your usage will be reflected in your credit file.

Will you get an arranged overdraft?

Use our eligibility calculator and find out. It won’t leave a mark on your credit file.

Get started

Apply for an M Plus Current Account to access our linked M Plus Saver.

What kind of account do you want?

Get started

Apply for an M Plus Current Account to access our linked M Plus Saver.

What kind of account do you want?

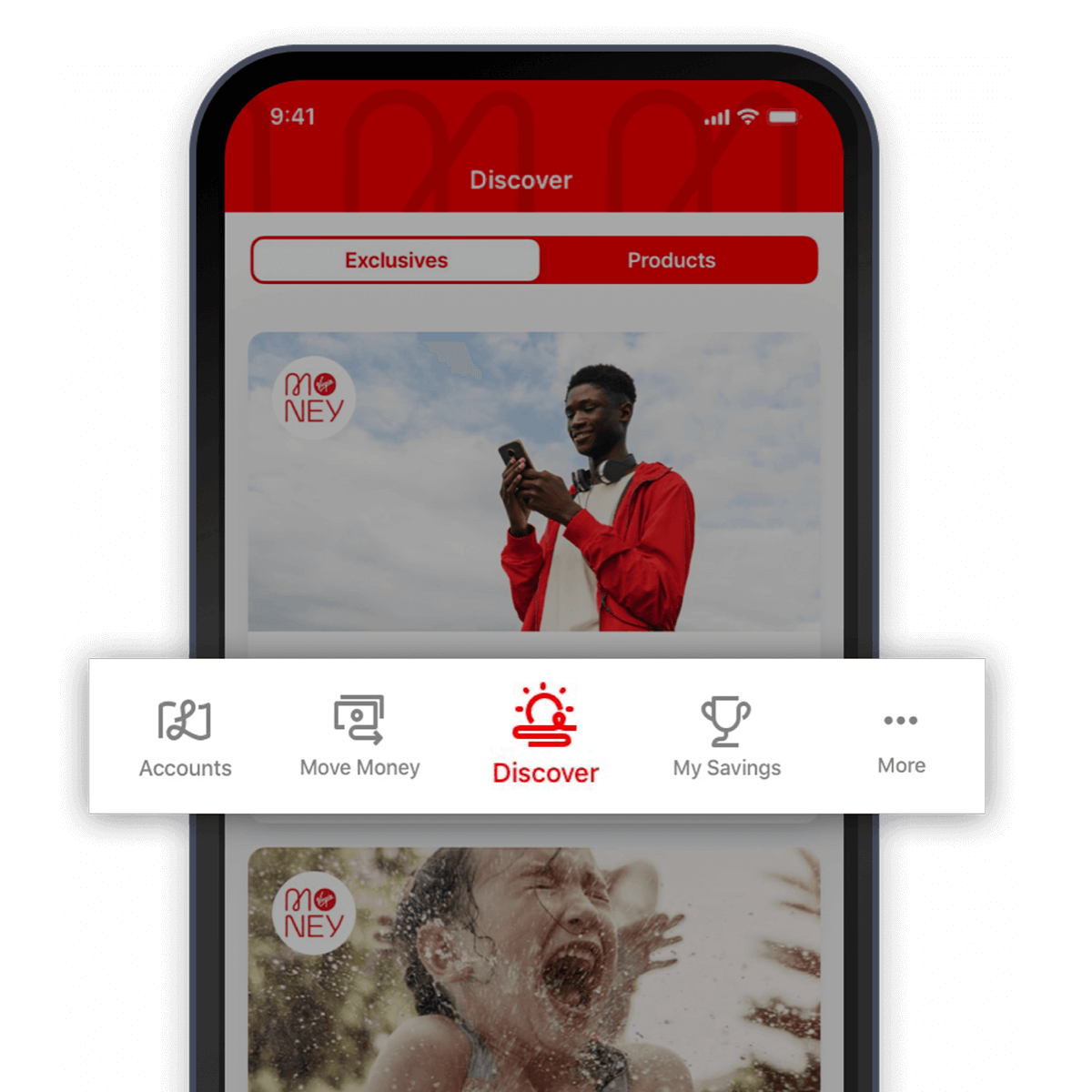

Virgin Money rewards

Discover your rewards. Brighten up your world with exclusive offers in our app.

- Cashback on your spending

- Cashback in your hands when you spend with top brands

- Boss your bills

- Get the best deals on your household bills with Youtility

- Looking for a loan?

- Special surprise or a serious buy? We’ve got a loan you’ll love

Our app makes

money easy

It's packed full of clever tools to help you budget, top up your savings and sort out your spending.

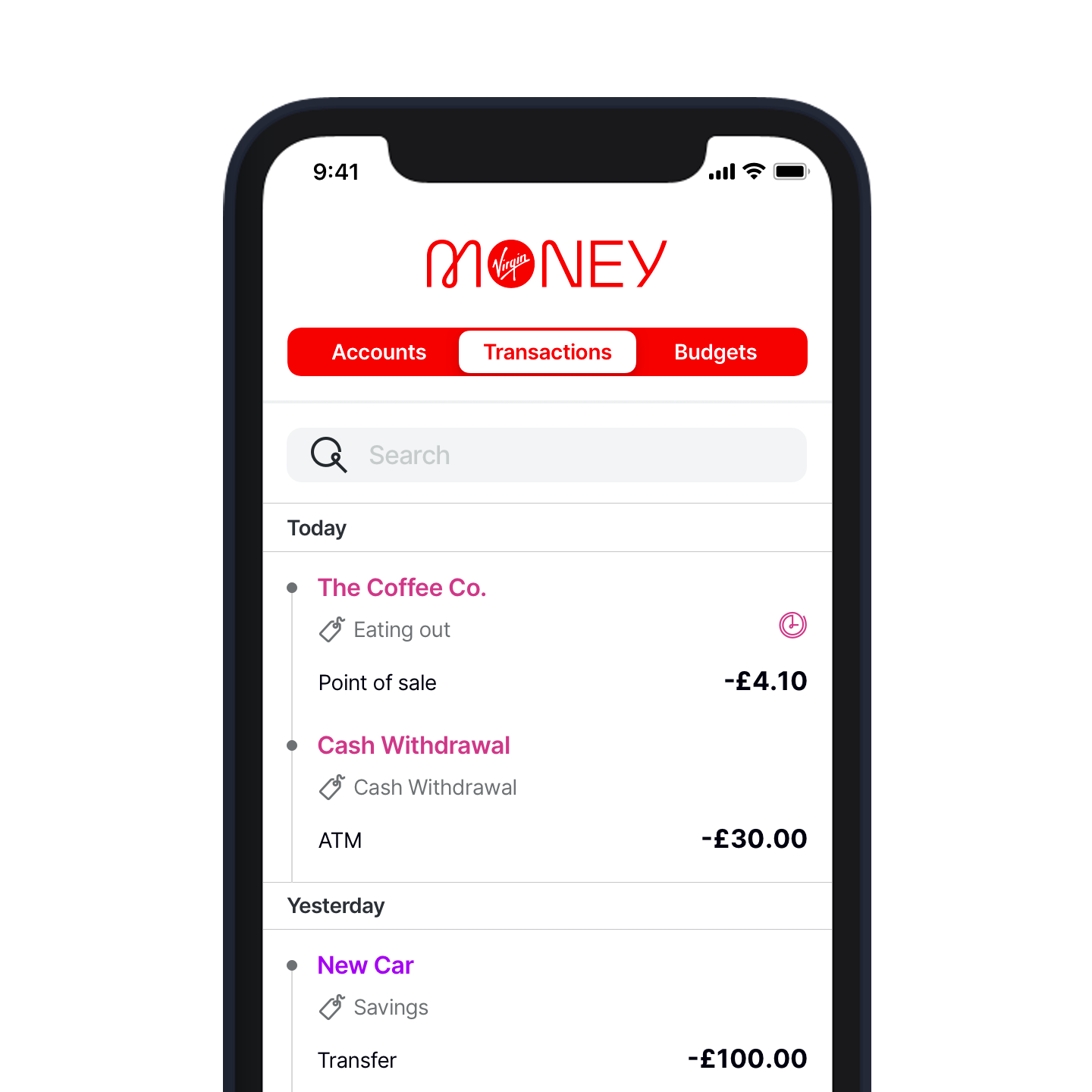

Track your ins and outs

View transactions and sort your spending by category

Save savvily

Set aside money for those must haves, with Savings Pots

Budget better

Gone over-budget? The app lets you know

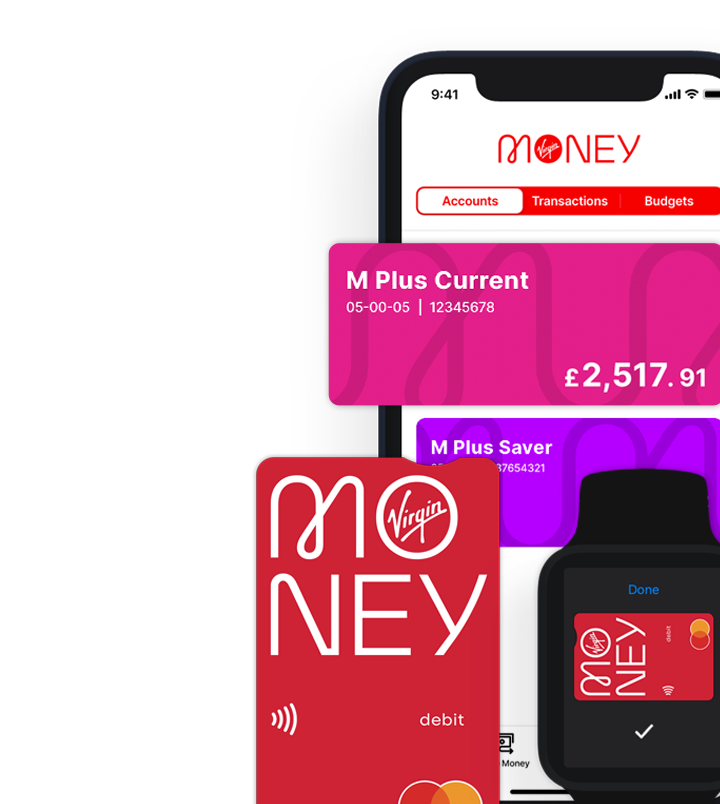

Pay easily

Just a fingertip away with Apple Pay and Google Pay

Protecting your money

- Security

- We're all over your online transactions to make sure it's really you making them.

More about security - FSCS guarantee

- Your eligible deposits with Virgin Money are covered up to £120,000 per person.

View the FSCS guarantee - Current Account Switch Guarantee

- It's easy to use our switching service, and it's all backed by the Current Account Switch Guarantee.

More on switching

Which account has your name on it?

This isn't the only current account we can offer you. To help you decide if it's the one for your business, see how it stacks up against the others.

Compare accounts

1 AER (Annual Equivalent Rate). The Annual Equivalent Rate illustrates what the interest rate would be if interest was paid and compounded once each year.

2 Interest will be paid gross. Gross rate interest is the interest payable without taking account of any tax payable.

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries.

Google and Google Pay are trademarks of Google LLC.