An online business bank account for all the upstarts

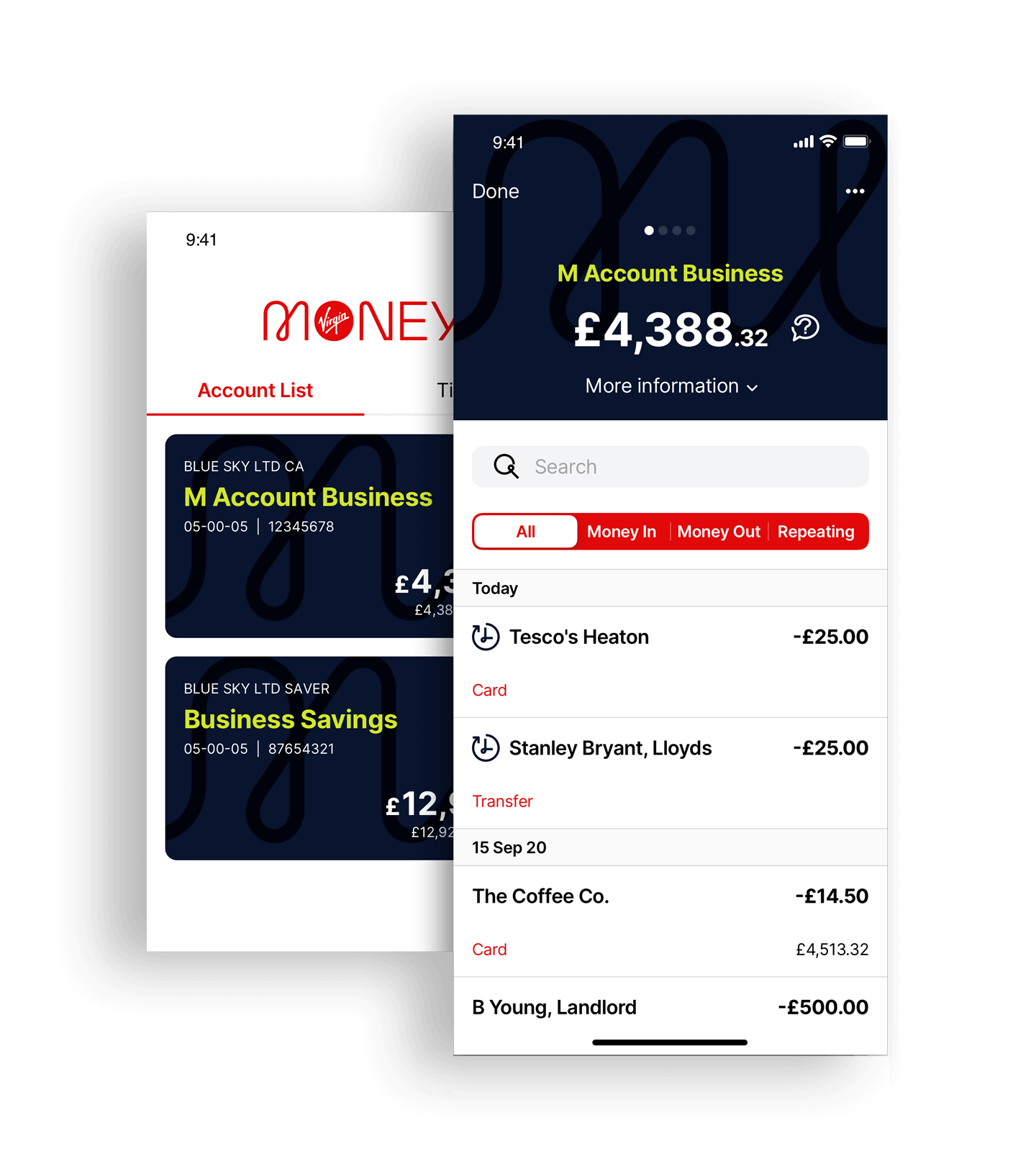

Designed for businesses with a turnover of less than £1million, the M Account for Business is a Five-Star Rated online business bank account that gives you free digital banking for all your everyday needs.

M Account for Business eligibility- No monthly fee and free online business banking

- 0.25% cashback on debit card purchases

- Fast digital sign up

- Five-Star Rated by Moneyfacts

Featured business bank account benefits

No monthly fee

£0

per month

The M Account for Business is an easy-to-use online business bank account, complete with money management tools. All with no monthly fee and free day-to-day digital banking.

Boost your Cashback

0.25%

M Account for Business customers will earn 0.25% Cashback on debit card purchases. Terms and exclusions apply. Link opens in a new window

Construction trades special offer

Open an M Account for Business to get a truckload of discounts and benefits...

- £4 Costa Coffee voucher every month for a year

- 0.5% unlimited cashback on trade supplies

- Money off breakdown cover and business insurance

Terms and conditions apply

A closer look at our online business bank account

Who's it for?

- Start-Ups

- Sole traders

- Limited Companies

- Limited Liability Partnerships

- Partnerships

- Those with an annual turnover less than £1million

What does it work with?

- Compatible with Apple and Google Pay

- Can be integrated with SageFrom Business Internet Banking and our app, you can integrate with Sage

- Can be integrated with XeroFrom Business Internet Banking and our app, you can integrate with Xero

- Can be integrated with QuickBooksFrom Business Internet Banking and our app, you can integrate with QuickBooks

- Automated business spending categorisation

What are the features?

- Make free UK bank transfersNo payment charges on UK bank transfers. You can make a domestic bank transfer (we are part of the UK’s Faster Payments network) of up to £30,000 per transaction in your app / on Business Internet Banking

- Mastercard discountsMastercard discounts available when you use your Debit Card at selected merchants, including tax software, travel and more. Savings discounts Terms and Conditions apply

- In-app cheque scanning

- Manage scheduled payments

- Instant payment notifications

- Expert mentoring and guidance from Virgin Startup

- Paper-free statements and most letters

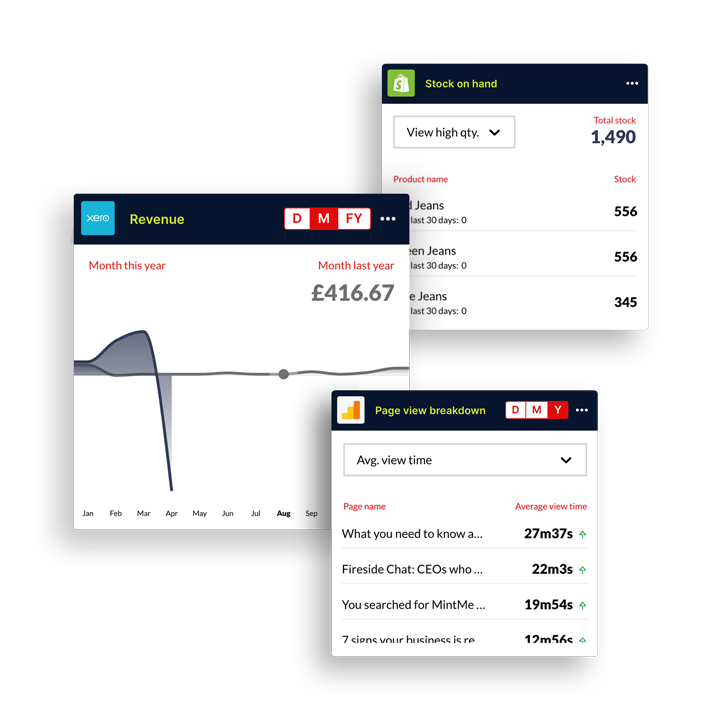

M-Track dashboard

Power up your business data and manage it in one place with our free insights platform.

- Connect with a mix of key business tools.

- Use insights to help dig deeper and plan ahead.

- Access expertise from our business network.

Good to know

What you'll need to open an account

Together with other UK banks and UK Finance, we've established a basic set of information required to open a new business bank account online.

Switch your current account

Switching to us is straightforward with the Current Account Switch Service. You choose the date you'd like to switch and we'll do the rest.

Protecting your money

Sleep easy with protection on eligible deposits up to £120,000 per business. Provided through the Financial Services Compensation Scheme (FSCS).

How to open an M Account for Business

Check if you can open an account. And find out what you’ll need when you apply.

Check if you're eligible

To open an account, your business needs:

- an annual turnover of less than £1m

- an owner, director, senior manager or account signatory aged 18 or over

- to operate and be based in the UK, excluding the Channel Islands, Isle of Man and Northern Ireland

Your business won't be able to open an account if:

- it has nominee shareholders

- any director has ever been disqualified as a company director

- the person applying for the account is bankrupt

Or if your business is:

- a shell bank

- an unregistered high value dealer

- a business related to medicinal cannabis

- a bureau de change, money transmitter, cheque cashing agency, or other money services business, as its primary or secondary business activity

- a club, society, unregistered charity, or non-profit organisation

- trading with, or operating in, Iran, Syria, North Korea or Crimea (Ukrainian territory)

Bringing Nationwide and Virgin Money together

Following Court approval on 23 February 2026, Virgin Money’s business is expected to become part of Nationwide on 2 April 2026. These changes could impact your protection under the Financial Services Compensation Scheme (FSCS).

Understand what this means for youApply for an account

Open an M Account for Business to get free online banking, cashback, smart tools and more…

An easy way to track, budget and pay

Show your money who's boss with our super-smart online business banking tools.

- Manage your ins and outs

- View previous statements. Set up and manage Direct Debits and standing orders.

- Be in the know

- Set your weekly transaction and balance alerts as you like it.

- Tap, touch, ta-da!

- Deposit cheques digitally and pay with Apple Pay and Google Pay.

Which account has your name on it?

This isn't the only business current account we can offer you. To help you decide if it's the one for your business, see how it stacks up against the others.

Compare business current accounts