Money makes us feel a number of ways. From happy, empowered and confident to worried, anxious and confused. This is why it’s vital that we understand our money and use knowledge as power. To help, we’ve had a look at where most Brits are getting their financial education and done some current account jargon busting.

Where are Brits going for their financial education?

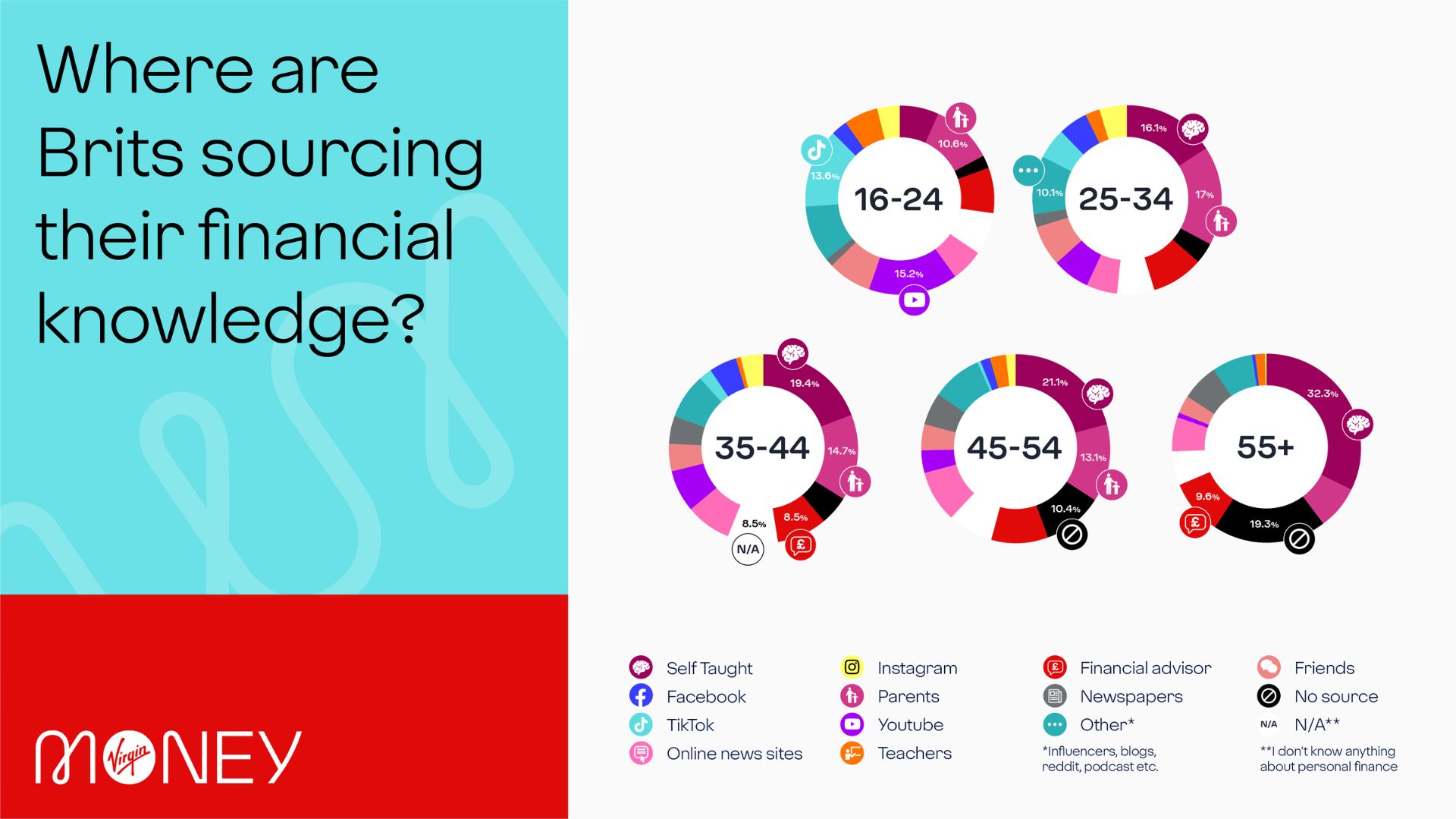

It’s no surprise that YouTube came out as the most popular source of financial information amongst 16-24-year-old Brits. From ‘how-to’ videos to step-by-step breakdowns, YouTube is littered with endless videos on how to handle your money. Next up, the revolutionary video app, TikTok, came out as the second most used source of financial knowledge for young Brits.

Only 8% of 16-24-year-old respondents said that they’ve spoken to a financial advisor - and only 6% of young participants said that they learnt about finance at school. As for those who claim to have ‘taught themselves’ about the ins and outs of finances, survey respondents aged 55 and above scored a high 32%, saying that they had done their own research - along with 21% of 45-54-year-olds. Comparably, only 7% of 16-24-year-olds have taught themselves about the world of finance.

Jargon buster

Even if you know where to go, understanding the jargon that sometimes comes with money can be tricky. We asked people in our survey to let us know what had them scratching their heads when it came to current accounts Link opens in a new window. We’ve broken down the top seven misunderstood terms for you here:

1. Direct debit

When you agree to a regular payment with a company (for something like a gym membership or On Demand TV say) and let them instruct your bank to pay your bill by transferring money from your account to their account. Your bank will then set up a Direct Debit to do this on a date you’ve agreed. The amount of this Direct Debit can sometimes vary depending on the service.

2. Overdraft

An overdraft is a facility that allows you to borrow money so that you can continue to make purchases after your balance has hit zero. It’s the cheapest and risk-free way to borrow a lump sum for a short time and is intended for occasional use. You should aim to repay your overdraft borrowing as quickly as possible and use it responsibly as your usage will be reflected in your credit file.

The difference between an arranged overdraft and an unarranged one can be broken down simply:

- An arranged overdraft is, quite literally, ‘arranged’ in advance - you and your bank agree in advance that you can borrow money when there is no money left in your account. The agreement determines a maximum amount that can be borrowed, and whether fees and interest will be charged.

- An unarranged overdraft is an unplanned overdraft - this is when you borrow money when there is no money left in your account (or when you've gone past your arranged overdraft limit) and this has not been agreed with your bank in advance.

3. Credit balance

A credit balance is the amount of money held in your personal current account - essentially, it’s your bank balance and the amount of money that you have available to spend.

4. Interest rate

An interest rate tells you how much you could earn from saving money with your bank and how much you owe if you borrow a sum from the bank (via overdraft, for example).

5. Standing order

A standing order is an instruction from you to your bank to send an automated fixed amount of money from your account to another account. Standing orders are often set up for rent payments, charity donations or regular payments into a savings account from your current account.

6. Credit rating

A credit rating is a measurement of a business or person's ability to fulfil a financial obligation - it’s essentially an analysis of how risky you are as a financial investment. Your credit rating can be negatively affected by current account activity like late payments for bills or going over an arranged overdraft.

7. Financial conduct authority (FCA)

The FCA, or the Financial Conduct Authority, is responsible for regulating the financial services industry in the United Kingdom. This includes ensuring that the financial markets are honest and fair for consumers, promoting healthy competition between financial service providers and protecting customers from scams and other risks.

Hopefully these jargon-busters have helped you feel more confident and empowered in handling your personal finances. If you’re looking for more ways to feel brighter about money check out our other articles.

Methodology

Survey of 2,006 general UK consumers carried out by Censuswide on behalf of Virgin Money.

Responses collected 09/06/2022 - 13/06/2022.

Research on financial statements Brits did or did not agree with was sourced from YouGov.