Let's get the ball rolling

Follow these three steps to transfer to us.

- Find your old pensions and gather the info you’ll need.

- Check that transferring your pensions to us is right for you.

- Choose your new pension - then open your account and tell us about the pensions you want to transfer.

Step 1

Find your old pensions and gather the info you'll need for each one you want to transfer to us:

- Pensions provider name

- Account reference

- Value of your pensions

Step 2

Check that transferring your pensions to us is right for you.

Here are some things to consider before moving each pension to us. Your current providers can give you the info you need.

- Your unique account reference

- What type of pensions you have

- Chosen retirement age

- The value of your pensions

- The transfer value of your pensions (this may be different to the value of your pensions)

- Do they charge you to transfer your pensions

- Do your pensions provide any special benefits

If your pensions have any safeguarded benefits, or other guaranteed features you could lose them if you transfer your pensions to another provider. Here are some of the more common ones:

- Final salary or defined benefit pensions schemes provide a retirement income for life

- Guaranteed Annuity Rates (GAR) promise a guaranteed rate if you buy an annuity with the same provider

- Guaranteed Minimum Pensions (GMP) and Section 9(2B) rights provide a guaranteed minimum fixed retirement income

- Pensions review top-up plans offer a guaranteed level of income

- Guaranteed lump sums pay a sum of money in circumstances such as the death of a pensions holder.

- Guaranteed investment returns during accumulation (e.g. with profits) promise a guaranteed investment income or growth

- Scheme specific tax-free cash/enhanced tax-free cash

- That our pensions give you the investment options and features you need, and our charges compare with those of your existing provider

- If your provider will charge you for transferring - if there’s a fee, the cost could outweigh the potential gains

Unfortunately, not all pensions can be transferred to Virgin Money. We can’t accept:

- Pensions with a guaranteed annuity rate

- Pensions with safeguarded benefits or guarantees, such as a Guaranteed Minimum Pensions

- Pensions you've already taken money from

- Defined benefit pensions (e.g. final salary schemes)

- If your pension has a safeguarded benefit and is worth £30,000 or more, you must take independent financial advice before transferring it. Visit unbiased.co.uk to find an adviser in your area

- If your pension offers a level of income in retirement but the pension, including the benefit, is worth less than £30,000 then you don’t need to get financial advice, but the benefit will probably be lost if you transfer it

- If you’re not sure whether to transfer your pensions, get in touch with your current pensions provider or get independent financial advice before going ahead

- Alternatively, if you’re over 50 and have a Defined Contribution Pension, the Government’s Pension Wise service provides a free 45 to 60-minute guidance session with a pensions specialist. You can book an appointment with them online, or by phoning 0800 138 3944 – they’re open Monday to Friday, 8am to 8pm

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

Step 3

Choose your new pension - then open your account and tell us about the pensions you want to transfer.

Managed for you

Navigator automatically steers your pension investments based on your age. It’s the hands-off, feet-up option. Here’s everything you need to know in 60 seconds.

Explore NavigatorManaged by you

With Self-Drive you're in the driving seat - choosing your investments and making your own route for retirement.

Self-Drive PensionMove your pensions to us

First up, choose which easy pension option is for you:

Helpful guides

New to pensions or just want to buff up your knowledge? Count on us to help.

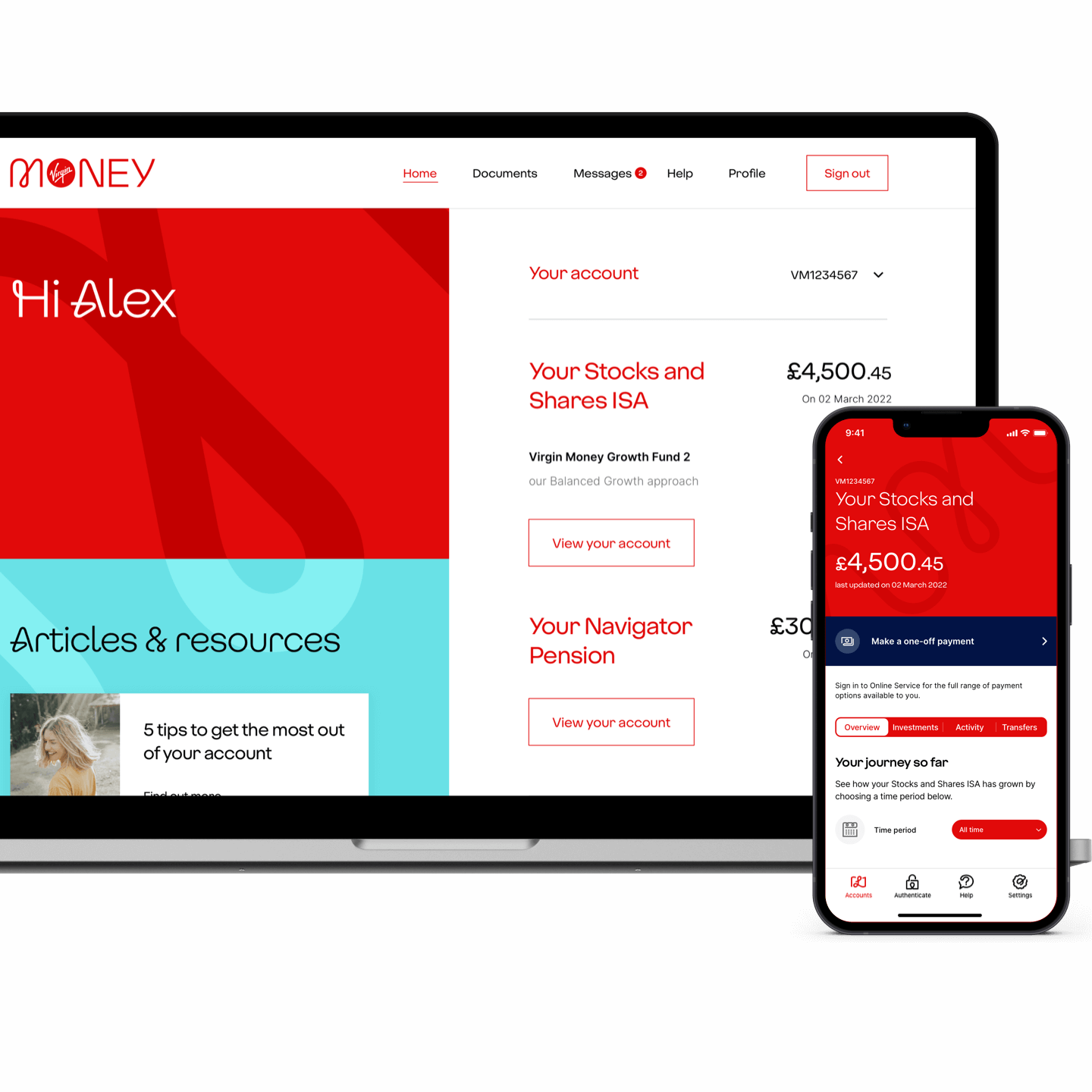

Stay in control with our Online Service and app

Making it easy to keep track of your investments and pensions wherever you are.

Explore Online Service

The serious bits

- Charges

- Our charges are up to 0.75% in total each year, based on the value of your account. This is made up of two clear and simple charges. An Account Charge of 0.30% for managing your account and an Annual Management Charge of up to 0.45% for managing your investments.

More about our charges - Our Terms

- Everything you need to know, explained clearly. Includes the Key Features of the Pension and how we use your personal information.

Terms Link opens in a new window Our funds and charges Link opens in a new window - Security

- We help keep you safe online with our extra level of protection.

More about security - Protecting your money

- In the unlikely event we can’t meet our financial obligations, you may be entitled to compensation from the Financial Service Compensation Scheme (FSCS) up to a maximum value of £85,000.

Find out about the FSCS - Fund Value Assessment report

- An evaluation of our funds' value for money and performance. Its purpose is to report on whether we believe we are providing good value. It also outlines our plans if there are things we think we can improve.

Find out about the Fund Value Assessment report

Got a question?

We've got the answer.

We don’t charge you for transferring your pension, but your existing provider might. So, it’s best to double-check with them first.

If your pensions has a safeguarded benefit and is worth £30,000 or more, government rules say you must seek independent financial advice before you can transfer your pensions. To find an adviser in your area, visit unbiased.co.uk.

If you’re unsure whether you should transfer your pensions, get in touch with your current pensions provider, check out moneyhelper.org or seek independent financial advice before going ahead.

Or, if you’re over 50, the government’s Pension Wise service provides a free 45 to 60 minute guidance session with a pension specialist. You can book an appointment with them online, or by phoning 0800 138 3944 – they’re open Monday to Friday, 8am to 8pm.

No, you can transfer any pensions that we accept whenever you like using Online Service.