Want to transfer or combine your pensions?

We'll help you move them to us.

Better together

Wouldn't it be good to see your pensions in one place? Transferring them to us makes it easier to track and manage - and we don't charge a fee for it either.

Start saving for a brighter retirement

Choose from two easy options:

Managed for you

Navigator automatically steers your pension investments based on your age. It’s like sat nav for your retirement journey.

Explore NavigatorManaged by you

Self-Drive is the hands-on option. You choose your pension investments and steer your own route to retirement.

Explore Self-DriveRemember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

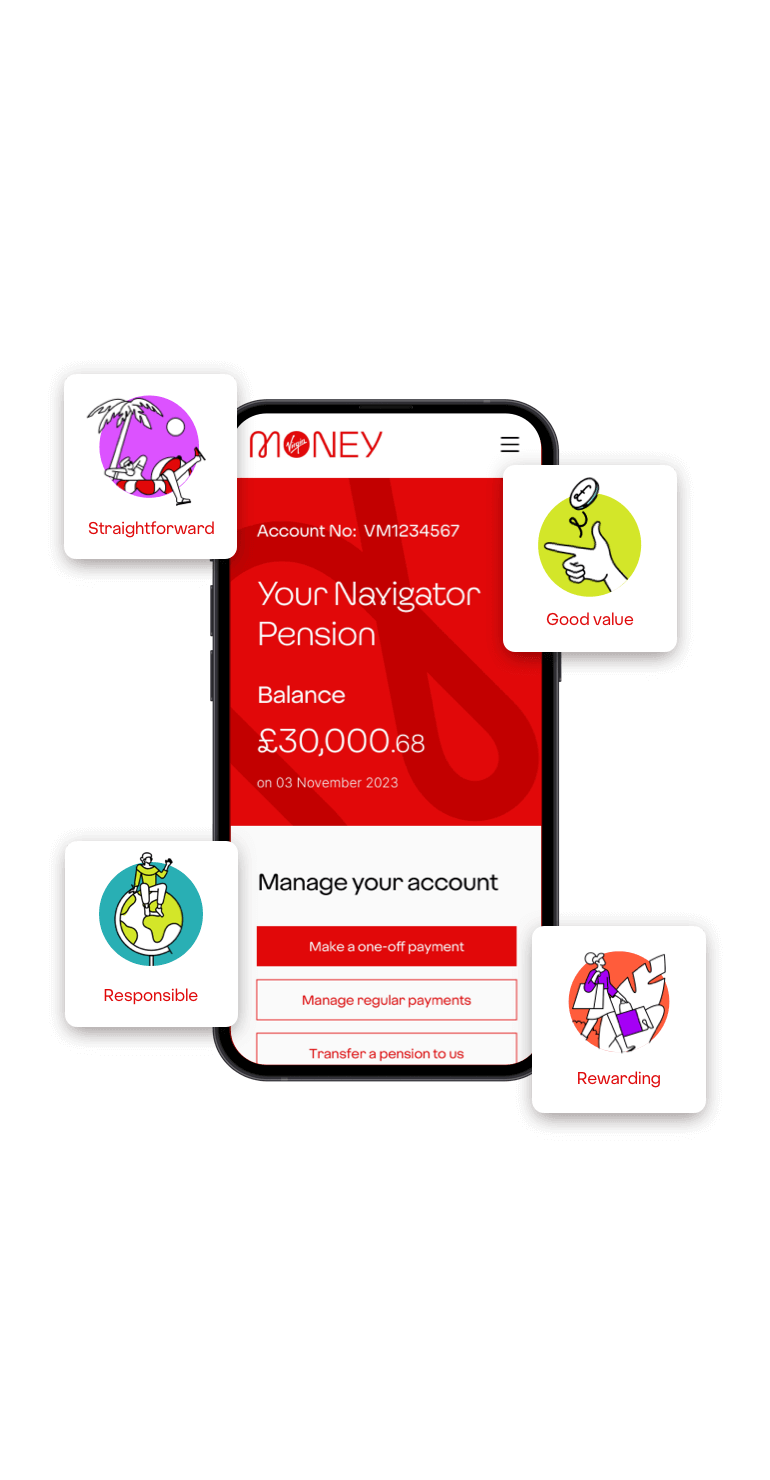

Why choose a Virgin Money Pension

Our personal pension helps you plan for a brighter future with two super-smart and straightforward choices to grow your money.

Start from £25 a month

or move your pensions to us.

- Straightforward

- No jargon, no waffle, we make pensions simple.

- Good value

- Our experts invest your money worldwide to reduce risk and help it grow, at a fair price.

- Responsible

- We carefully consider the influence your investments will have on people and the planet.

- Rewarding

- Treat yourself with rewards from the Virgin family and beyond.

Currently, with this product, you can only access your pension money as a lump sum from age 55 (57 from 2028). So, if you’re looking for flexible access, this might not be the pension for you.

Imagine your retirement

Our retirement tool will help you understand the income you'll need for the retirement of your dreams.

Use our retirement plannerHelpful guides

New to pensions or just want to buff up your knowledge? Count on us to help.

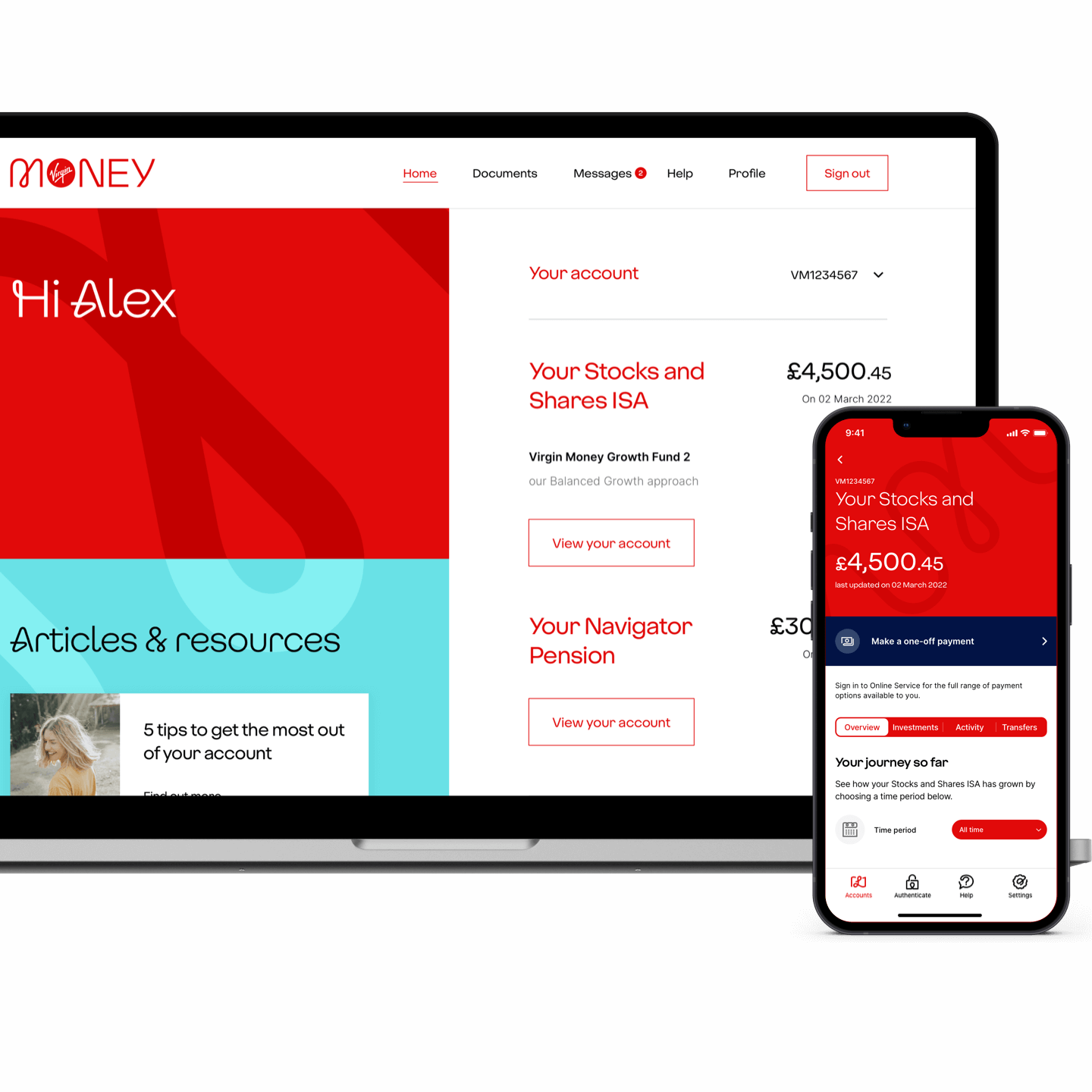

Stay in control with our Online Service and app

Making it easy to keep track of your investments and pension wherever you are.

Explore Online Service