Find me a card that lets me

Transfer a balance

Move all your current credit card debts to just one card.

Representative 24.9% APR (variable).

Transfer money to my current account

Pay money straight into your current account with a money transfer card.

Representative 24.9% APR (variable).

Transfer a balance and make everyday purchases

If you're looking to spend on your card - at home or abroad - and transfer a balance, do it all with one card.

Representative 24.9% APR (variable).

Earn Virgin Points

Earn Virgin Points whenever you spend on your credit card. Then use them to delight in flights, rewards and upgrades.

Representative 26.9% APR (variable).

Buy now pay later

Virgin Money Slyce is a more rewarding way to buy now, pay later.

Representative 19.5% APR (variable).

Room to breathe

A balance transfer card with competitive introductory offers. Check to see if you're eligible.

Representative 24.9% APR (variable).

Credit subject to status.

Check balance transfer credit card eligibility

Existing Customers

Learn how to manage your account like a pro with our guides, and make changes easily using our online forms.

Buy now, pay better

Meet Virgin Money Slyce, the more rewarding way to pay later

Discover Virgin Money Slyce

A card that really takes you places

Earn Virgin Points with a Virgin Atlantic Credit Card. Representative 26.9% APR (variable). Terms apply.

Find out more

Show your true colours

Show your love for the club and get the chance to win rewards with the Manchester United Credit Card.

Representative 24.9% APR (variable).

Check your eligibility

Our checker is a quick way to see your chances of being accepted for a card, and it won't affect your credit rating.

You'll need the Virgin Money Credit Card app to manage your credit card.

Check eligibility

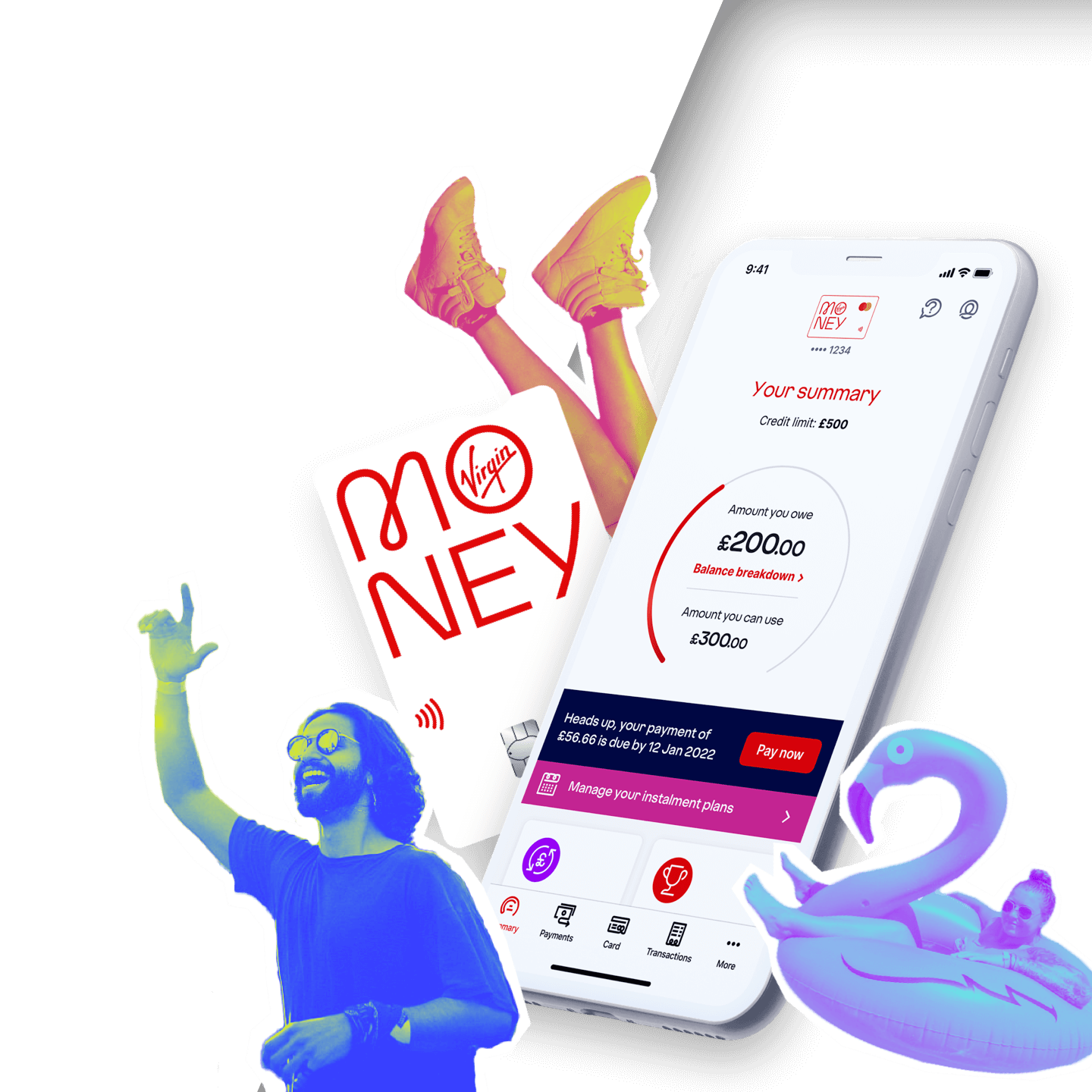

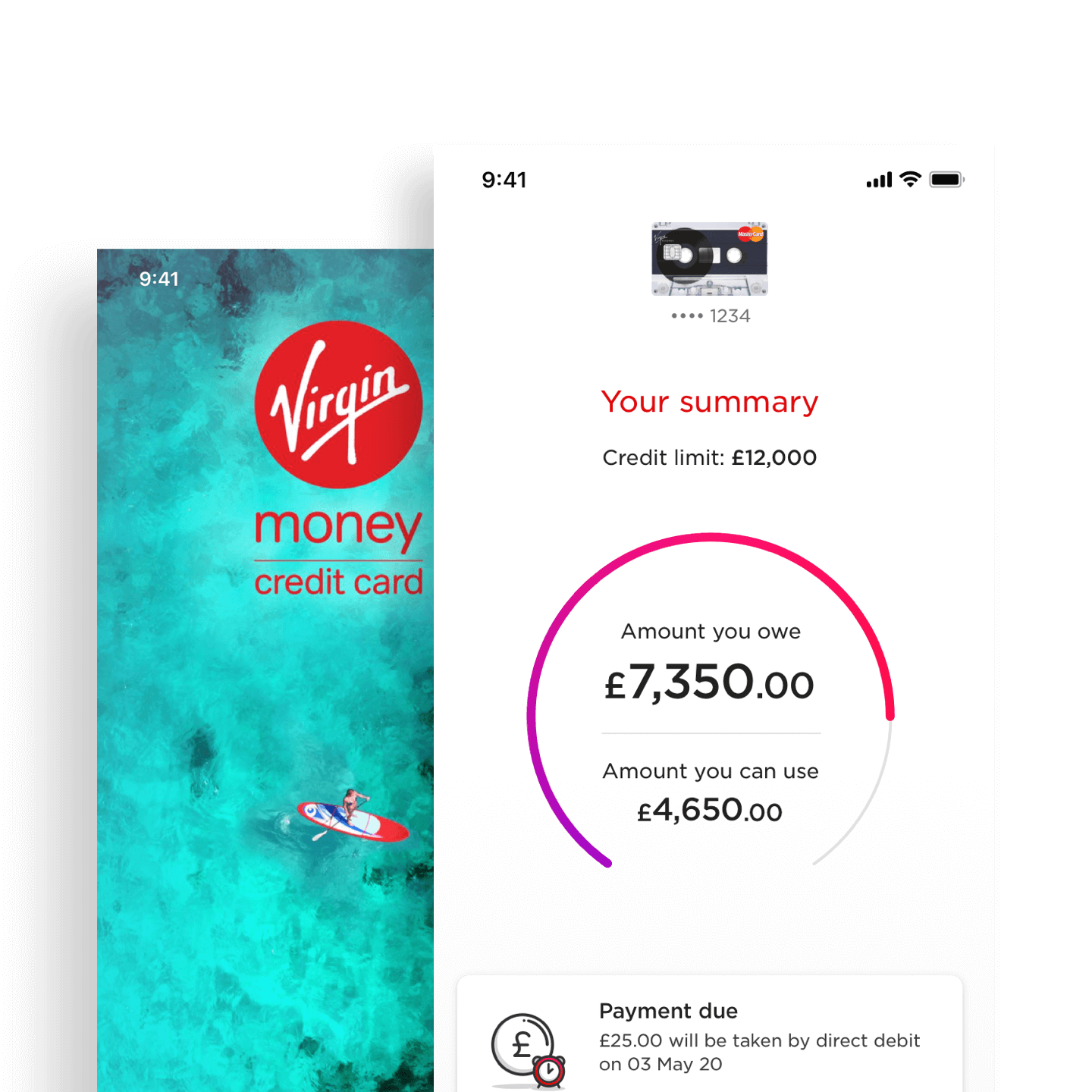

Our app makes money easy

Manage your card, master your spending

You'll need the Virgin Money Credit Card app to manage your credit card digitally.

- Track your balance and transactions

- View your latest transactions and keep tabs on your balance

- Pay with ease

- Set up and manage your Direct Debit, or make a one-off payment

- Manage balance and money transfers

- Easily transfer a balance or move money into your account

- Manage Your Card

- Simply and securely view your PIN, report your card lost & stolen

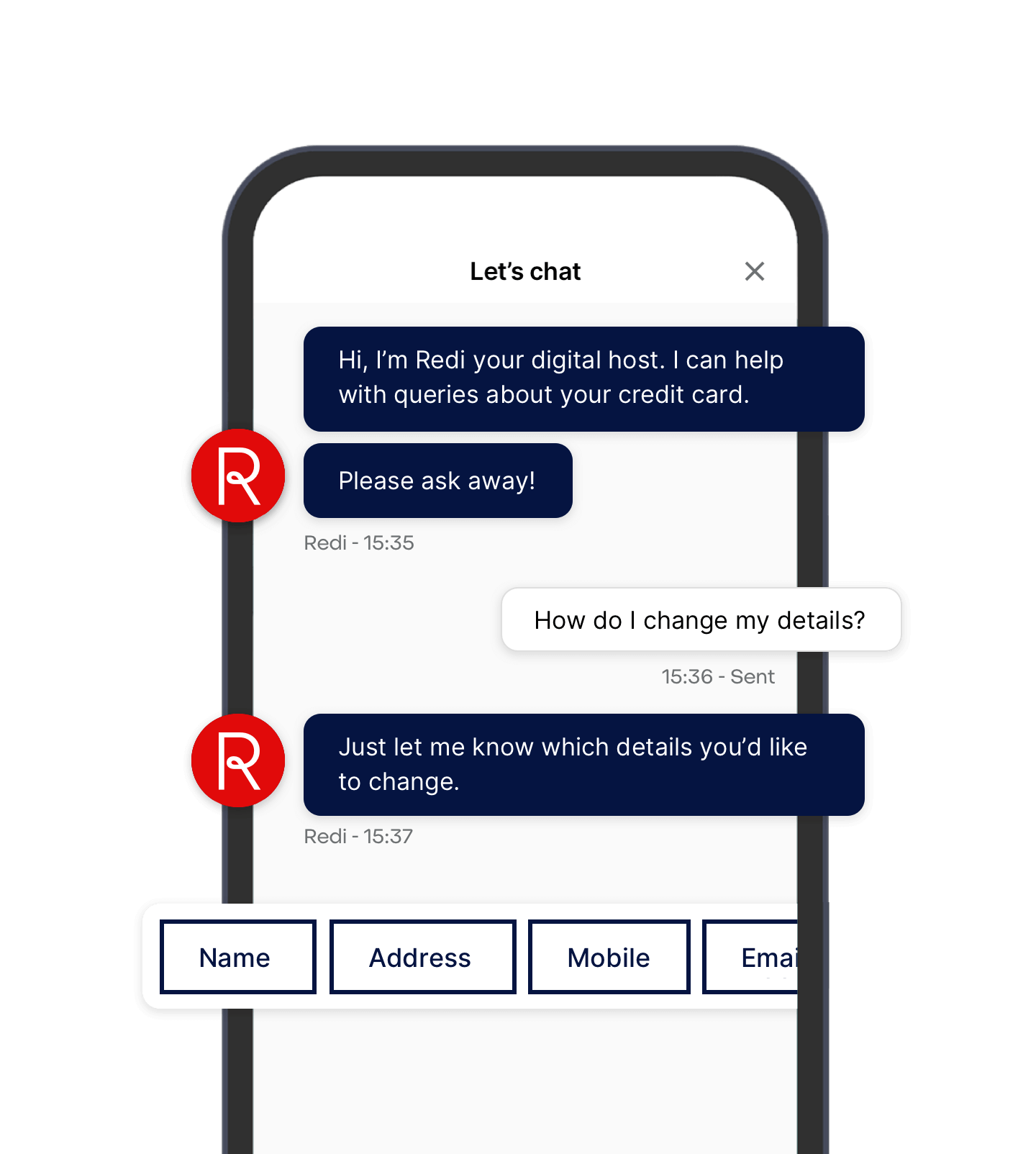

Say hi to Redi

Need help? Get 24/7 support with your credit card from Redi, our digital host. Start a chat in the app for instant answers to your questions.

Learn more

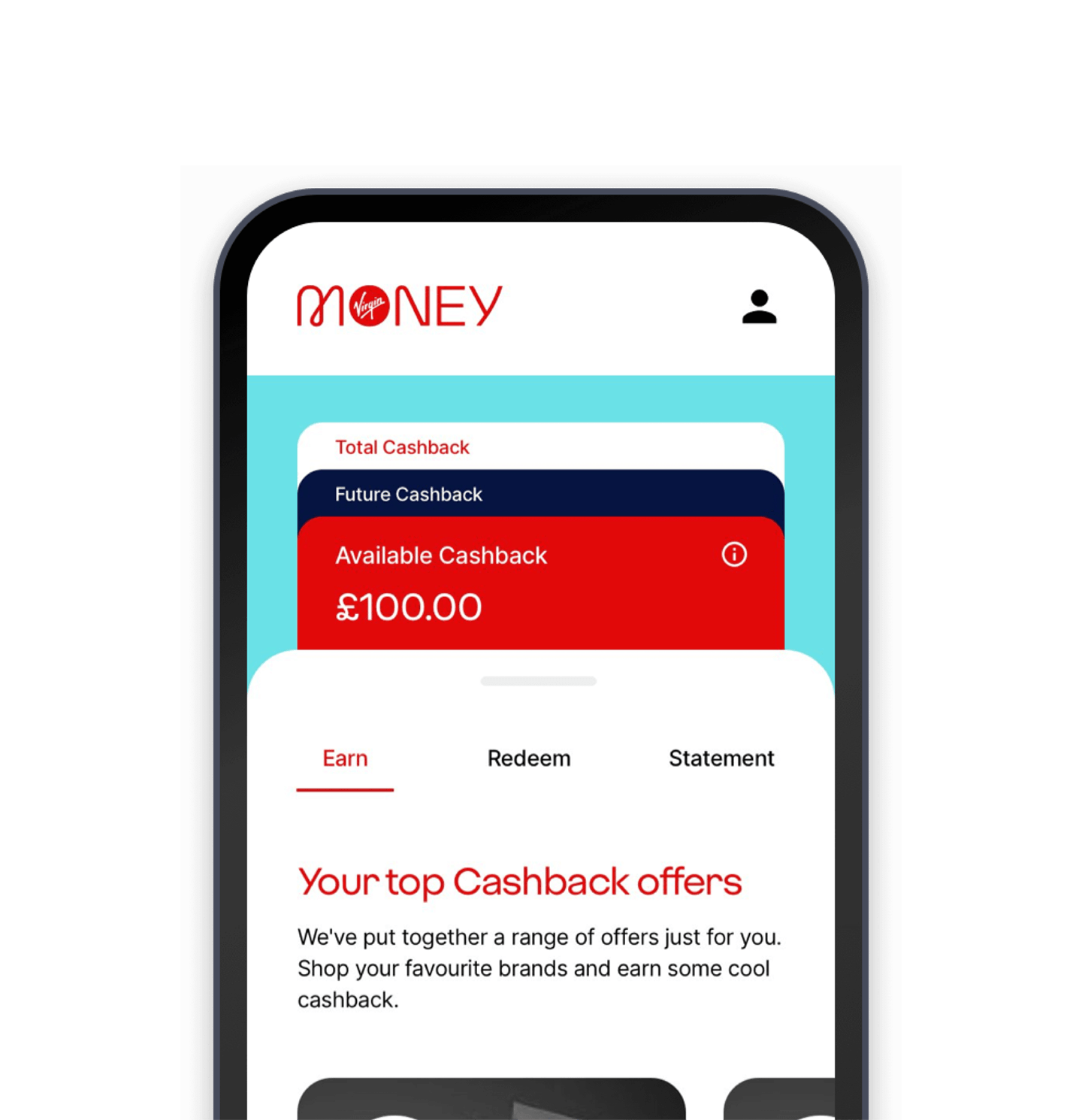

Virgin Money Cashback

Now you can use our credit card app to get cashback with your Virgin Money credit card.

Have you joined Virgin Red yet?

Join the rewards club that revolves around you. Virgin Red terms apply. Link opens in a new window UK only. 18+.

Discover Virgin Red

Virgin Money Stores

A new generation of creative and community-focussed spaces on the high street, designed to broaden people’s horizons and brighten their lives.

Discover our storesThe legal bits

Time to give your scrolly finger a workout

You’ll need to make your minimum payment when it’s due. If we do not receive the minimum payment when it’s due, or you go over your credit limit, we will withdraw the promotional rate with effect from the start of that statement period.

When a promotional rate ends or is withdrawn, we charge the current standard interest rate that applies to that transaction.

You will not be able to transfer a balance from another Virgin Money, Clydesdale Bank, Yorkshire Bank or B credit card and should not use your card to repay other borrowing from Clydesdale Bank plc.

Credit is available, subject to status, only to UK residents aged 18 or over.

Calls are charged at your service provider’s prevailing rate and may be monitored and recorded.

The Virgin Atlantic Credit Card is issued by Clydesdale Bank plc (trading as Virgin Money). Registered in Scotland (Company No. SC001111). Registered Office: 177 Bothwell Street, Glasgow, G2 7ER. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Virgin Money adheres to the Standard of Lending Practice which are monitored and enforced by the Lending Standards Board: www.lendingstandardsboard.org.uk

Your copy of the Statement of Lender and Borrower Responsibilities Link opens in a new window